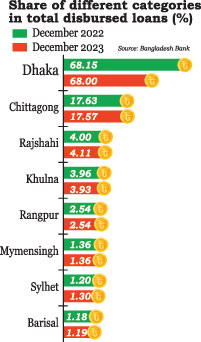

Over 86pc of bank loans disbursed in Dhaka-Ctg

Zarif Mahmud : Most of the total loans of the banking sector are concentrated in Dhaka and Chittagong divisions. At the end of last December, the total loan amount of the banking sector stood at Tk 15 lakh 38 thousand 343 crores. Compared to the previous year, which is Tk 1 lakh 50 thousand 679 crore or 10.86 percent more. Out of this, about 86 percent has been given from Dhaka and Chittagong divisions. Such information has emerged in the latest report of Bangladesh Bank.

Those concerned said that as most of the bank loans are concentrated in Dhaka-Chittagong, most of the frauds have occurred in these areas.

Various incidents including benami and fake loans, smuggling of loan money abroad have put pressure on the entire sector. Again, most of the bank branches or business centers are expanding based on these two departments. As a result, employment industries are not developing in the same way in other departments. The central bank has given instructions to the banks at various times to prevent concentration of loans in the two categories. Currently, a program is underway on how to reduce the loan in these two categories and increase it in other categories with the financing of Bangladesh Bank.

According to the data of Bangladesh Bank, apart from loans for various reasons including industries, a large part of deposits is coming from Dhaka and Chittagong divisions. At the end of the year 2023, the total amount of bank deposits stood at Tk 17 lakh 49 thousand 132 crores. Out of this, 61.30 percent of Dhaka division. Chittagong Division, which was in second position, had 21.09 percent. It is followed by Khulna 4.20 percent, Rajshahi 3.98 percent, Sylhet 3.98 percent, Rangpur 1.94 percent, Barisal 1.90 percent and Mymensingh division 1.60 percent.

Meanwhile, for many years, the share of state-owned banks in the total loans was decreasing and the share of Shariah-based Islamic banks was increasing. Amid the ongoing liquidity crisis, that trend has changed. By 2023, the share of state-owned banks in total credit has increased to 21 percent.

The previous year which was 20.46 percent. And the share of Shariah-based banks decreased from 26.85 percent to 26.35 percent in 2022. In specialized banks, it increased from 2.78 percent to 2.82 percent.

The decrease of foreign banks has come down to 2.65 percent. At the end of the previous year, it was 2.82 percent. Apart from this, the share of private banks including Islamic banks decreased from 73.94 percent to 73.53 percent at the end of last year.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…