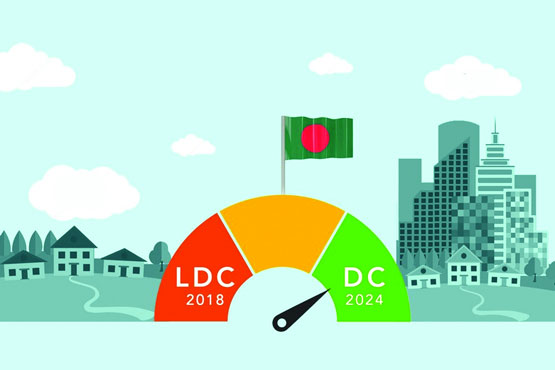

Bangladesh to face challenges of post LDC graduation

Zarif Mahmud: Bangladesh will enter the list of developing countries from least developed countries (LDC) in 2026. After transitioning to a developing country, the benefits that Bangladesh has been getting so far in business will be limited. In this, the country’s export sector will face new challenges. Preparations should be made in advance to face those challenges. Major reforms should be brought in the financial sector.

The country’s economy is going through a difficult time due to various adversities including inflation, dollar crisis, investment decline, foreign and domestic debt pressure. The government has formulated the national budget for the financial year 2024-25 with the aim of accelerating economic growth after the crisis, preparing the country for transition from the group of least developed countries by 2026 and facing potential challenges. However, the budget speech observed a lack of direction on the action plan to address the challenge of LDC transition.

Stakeholders say that while some challenges have been identified in the budget, there is a lack of direction on how to overcome them after transition to LDCs. If we calculate 2026 as the year of LDC transition, there is only one year left. In that case, several initiatives were needed to make traders more self-reliant and self-reliant, which is largely absent from the budget discourse.

Finance Minister Abul Hassan Mahmud Ali, while presenting the budget for the new financial year in the National Parliament on June 6, said that in addition to the transition from a less developed country to a developing country, the duty rate or tariff of some products must be rationalized in some cases to comply with the regulations of the World Trade Organization (WTO). One of the conditions for tariff rationalization is the phase-out of currently applicable minimum and tariff prices and regulatory duty-additional duties. As part of the commitment with the World Trade Organization, the tariff of the goods whose import level exceeds the rate specified in the tariff schedule will be brought to the bound tariff.

Last February, the UN Committee for Development Policy (CDP)’s 2024 Triennial Assessment Report highlighted Bangladesh’s potential for LDC transition. Whereas Bangladesh has passed quite well in the latest assessment of LDC transition in various indicators.

In that report, Bangladesh is in a promising state in terms of per capita income, human resources, climate and economic fragility. The report also mentions that Bangladesh is the only country that has passed or is about to become an LDC and has been challenged in all indicators in three consecutive assessments.

In the budget speech, the finance minister said, ‘As a step to prepare the domestic industry to face the challenge of LDC graduation, I propose to reduce some benefits and recommend 5 per cent CD instead of 1 per cent for various products. We are considering the logistics sector as a priority sector considering the need to diversify export products as well as reduce costs in the process of product circulation to meet the challenges of transition from LDC status.

The finance minister also hoped that through the development of the logistics sector, it will be possible to attract foreign investment in the LDC and maintain the competitiveness of Bangladesh’s export products and services.

In the February report, CDP showed that the six countries, including Bangladesh, which are on the path to LDC transition, face four challenges. The challenges are global crises, geopolitical tensions, climate change risks and increasing foreign aid.

However, Abul Hassan Mahmud Ali said that the government is making sector-wise action plans to face the challenge of LDC transition. In his budget speech, he said, there is a possibility of reduction in income from import duty due to transition from LDC, signing of free and preferential trade agreements with various countries and organizations and compliance with WTO conditions. Tariff rationalization should continue in preparation to meet the challenge of LDC graduation. The prevailing culture of tax exemptions at the individual, institutional and government levels must also be eradicated.

“Bangladesh has already been promoted from the least developed country to the developing category. “We are moving forward towards becoming an upper-middle income country by 2031 and a developed and smart Bangladesh by 2041,” the finance minister said in the speech, adding, “VAT exemption, rationalization of LDC transition and capacity of various sectors to increase the tax-GDP ratio.” Taking into consideration, initiatives have been taken to withdraw the exemption in phases.’

In the meantime, the date of Bangladesh’s LDC transition has also been fixed. If everything goes well, Bangladesh’s transition from LDC will take place on November 24, 2026 – according to information from the United Nations website, MTE said.

However, businessmen and economists say that the challenges of industrial self-reliance and transition to LDCs can’t be met simply by changing the tax structure or withdrawing policy support. For this, business-friendly environment must be ensured first.

After LDC transition in 2026, the government plans to gradually reduce incentives on all types of exports to make the industry self-reliant. As part of this, on January 30, Bangladesh Bank announced reduction of subsidy or cash assistance against the export of goods in 43 sectors including ready-made garments, agriculture and leather.

The central bank said in a circular that the sector may face challenges if the export cash assistance is completely withdrawn after LDC graduation. That’s why the government has decided to gradually reduce the rate of cash assistance in different phases from now on.

In this context, the notification also says that earlier, cash assistance ranging from 1 percent to 20 percent was given on the export earnings, so as to encourage the exporters and make them more competitive in the international market. Now the maximum rate of cash assistance on export earnings has been fixed at 15 percent and minimum at 5.5 percent. It will be applicable from January 1 to June 30 this year.

When asked, Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) vice-president Fazle Shamim Ehsan told, “We need a long-term plan. That plan should include a commitment to reduce harassment of traders. We have to reduce port charges and provide various opportunities to traders.

On the one hand, you will say that you are self-reliant, but on the other hand, you will not take any initiative to remove obstacles in business – that cannot be done. Corruption should be reduced, uninterrupted supply of gas and electricity to the industrial sector should be ensured and at the same time a different rate of dollar should be introduced. If these arrangements cannot be made, it will be difficult to face the challenge of graduation’- he added.

Executive Director of Research and Policy Integration for Development (RAPID) M Abu Yusuf told that there are several positive aspects in the proposed budget for the fiscal year 2024-25 to prepare and face the challenges of LDC transition. Most of the challenges have been identified in the budget. But the lack of proper guidance to overcome them is also evident. Incentives and subsidies should be withdrawn in preparation for LDC transition.

Although the government has taken many initiatives, he also felt that it is necessary to specify which country Bangladesh will sign a free trade agreement (FTA) with.

In a recent event, Commerce State Minister Ahsanul Islam Titu said, ‘As a developing country, we will start our journey in 2026. However, we will have the opportunity to enter the market of many countries until 2029. Later, as a developing country, these benefits will be limited. That is why we will continue those opportunities through bilateral agreements with different countries. In the meantime, we have initiated bilateral agreements with about 26 countries. We are working for easy access to the market of countries like India, Japan, China, Korea and Indonesia.

In this context, former chairman of National Board of Revenue (NBR) and adviser of International Business Forum of Bangladesh (IBFB) Abdul Majeed told, “We have to proceed with a proper action plan. If we cannot create the right environment for entrepreneurs to be self-reliant then graduation will be in jeopardy. These two years should be tried for self-reliance. Although some such goals were mentioned in the budget, many things were missing.

“GDP growth and budget size needed to be bigger. But that could not be done. Because, we have multifaceted economic crisis. In the budget of the previous years, there was a 12-13 percent increase in expenditure, but this time it has come down to less than 5 percent’ – added Abdul Majeed.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…