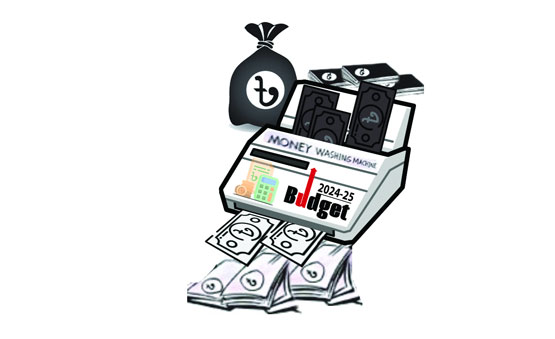

Black money to be whitened with 15pc tax

Budget for FY 2024-25

Mahfuz Emran : The opportunity to display black money in the individual sector is being given again. Under the new rules, black money can be turned into white without question by paying only 15 percent tax. This information is known from responsible sources.In the budget of the next financial year (2024-25), there is no more opportunity to invest black money in economic zones or hi-tech parks. The National Board of Revenue (NBR) took this decision after not getting the expected response.

To bring black money into the mainstream of the economy, the 2019-20 budget allowed unquestioned investment in economic zones or hi-tech parks.

The then finance minister AHM Mustafa Kamal said in the budget speech that the income arising from production of goods or services in economic zones and hi-tech parks has been given tax exemption at various rates for 10 years. A tax of 10 percent on the money invested from undisclosed income in setting up industries in economic zones and hi-tech parks to increase investment and create employment will not raise any question from the Income Tax Department about the source of that invested money.

After that several rounds of economic zones or hi-tech parks are given the opportunity to invest black money. But no one took this opportunity in long 5 years.

This facility is scheduled to expire on June 30 of the current financial year. Therefore, black money investment in new economic zones or hi-tech parks is not allowed as part of meeting the International Monetary Fund (IMF) conditions.

On February 4, Finance Minister Abul Hassan Mahmud Ali chaired an inter-ministerial meeting regarding the review of the macroeconomic situation of Bangladesh in the Ministry of Finance. Finance Secretary, Commerce Secretary, Economic Relations Department (ERD) Secretary, Financial Institutions Department Secretary, Expatriate Welfare and Foreign Employment Ministry Secretary, National Board of Revenue (NBR) Chairman and Bangladesh Bank Governor were present in the meeting. In the meeting, the NBR chairman said that the government is encouraging private investment through economic zones, which on the one hand helps in increasing foreign direct investment and on the other hand creates employment. But in this case, the tax exemption given by the government does not seem to be very effective. So, he opined that it is necessary to look into the matter.

Instead, an opportunity to legitimize black money or undeclared income is being offered under a general amnesty (tax amnesty). Of course, for this you will have to pay more income tax than before. Earlier black money could be whitened by 10 percent tax, in future it will be 15 percent. If the money is legalized in this way, no other organization of the government can question it.

Incidentally, in the existing Income Tax Act, there are three ways of showing investment by paying special tax. First, there is an opportunity to show flats in the return by paying income tax at a fixed rate per square meter area wise. Secondly, there is an opportunity to invest black money in any sector with an additional 10 percent penalty on the prescribed tax. Thirdly, the opportunity to invest black money without question in economic zones or hi-tech parks with 10 percent tax.

Sources said that Section 19AAAA of the old Income Tax Act will be included in the current Act in the next budget to bring undisclosed money into the mainstream of the economy. In the old law, the clause was added in the fiscal year 2020-21. Then more than 12 thousand taxpayers used this opportunity to whiten black money. There was not much response due to tougher conditions later on.

The budget for the fiscal year 2020-21 provides an opportunity to show undisclosed cash, savings bonds, government securities, bank deposits in income tax returns by paying 10 percent tax. At the same time flats are given a chance to be displayed by paying a fixed rate per square metre. Using this opportunity, 11,859 taxpayers whitened black money.

Among them, 286 people invested in the capital market, 1,645 people in land, 2,873 people in flats and 7,055 people showed cash. In the face of various criticisms, in the following year (2021-22 fiscal year), the provision of black money laundering was kept, but tough conditions were added by increasing the tax rate. Immovable and immovable properties are allowed to be displayed by paying an additional 5 percent tax (total of 26.25 percent) on cash, bank deposits, savings certificates, FDR payable tax. Due to non-response, the facility was canceled in the financial year 2022-23.

According to sources, in the next budget, an opportunity is being given to show undisclosed cash, bank deposits in the income tax return by paying a tax of 15 percent. Basically, this initiative is to bring black money into the mainstream of the economy. In this case, the amnesty facility remains as before. That is, no other agency of the government can question this.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…