Budgets never reduce inflation

Dr. Virupaksha Pal: No matter how much our finance ministers say that their main objective in the budget is to reduce inflation, it is just rhetoric. Or talk for the purpose of political popularity. Budget is not aimed at reducing inflation. That is even more unlikely in weakest revenue kingdoms like Bangladesh, where the government has no inclination to upset the top rich by raising direct taxes. If taxes are to be raised, figuring out where to put those taxes on middle- and lower-income people is a good example of the inventiveness of policymakers. So, the budget does not reduce inflation but increases it. Because the unearned money of the rich group increases the liquidity in the economy and keeps inflation rising or falling.

No need to look to the history of the last 50 years for the fact that the budget does not reduce inflation. Just two years ago, when inflation was around 12 percent, the finance minister, while announcing the budget for the fiscal year 2022-23, set an inflation target of 5.6 percent. No one wanted to know where he got this strange number from. There was no research. There was no economic projection. The result is what happened. Even in the last two years, it could not come close. Excuses came and still come from the Harappan era post-Covid supply crisis and Putin’s sudden invasion of Ukraine. The last reason is being called the ‘Ukraine War’ in our country in homage to Putin, the ‘son of democracy’.

With these reasons, a couple of advisers or ministerial officials added another airy theory when they got the opportunity, its name is American plot and conspiracy. Someone goes deeper and says that the development of Bangladesh is the envy of the western world. I read as a child, the cause of violence is the death of Kamsa. But Western parliaments are not dying. Rather, they have reduced inflation. Unemployment in the United States is now at 3.9 percent, the lowest it has been in 40 years. Inflation has also come down from around 10 percent in the last two years to three and a half percent now.

By following economics textbooks, the West has managed to bring about these benefits which Bangladesh has not. Because interest has been capped to benefit a special rich group. On the other hand, in order to facilitate the importers in some products, the value of the dollar against the taka has been forcibly reduced, causing losses to exports and remittances. Reserves are dangerously low and the danger is not yet over. Imports of raw materials and capital equipment have been reduced by about 30 percent to reduce the bleeding of reserves. It has reduced national growth for shortsightedness. Short supply of goods fueled inflation.

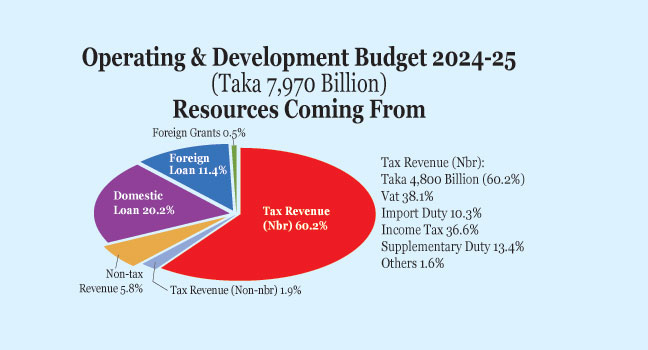

The budget is contradictory on the question of inflation. On the one hand, the greed of 7.5 percent growth and on the other hand, the dream of reducing the inflation rate of about 10 percent to only 6.5 percent is just a strange dream of wandering in the water and the shore at the same time. If the growth of this financial year is 5.6 percent according to the World Bank, then the matter of pulling it down to about 7 percent is contradictory according to the Phillips equation of the economy. Shouldn’t have been too much of a headache for growth now. No one expects a person with high blood pressure to finish first in a marathon. Economists also had a consensus on this which was not adopted in the budget. But the danger is that this little humiliation does not settle it. If the growth rate is high, other figures in the budget have to be adjusted accordingly. Everything then goes up in the Budgetary Framework spreadsheet. Since the fiscal capacity of governments is among the weakest in the world, meaning that governments are unwilling or in some cases unable to raise direct taxes on the rich, all the pressure is on budget deficits and excessive borrowing. It happened again. The budget deficit has increased by 8.3 percent to meet domestic borrowing by around 3 percent and external debt by around 20 percent. Despite this, the expectation that inflation will come down to 6.5 percent is economically contradictory.

The budget of Bangladesh is like a movie hero. There is a lot of fuss about him. But he doesn’t get any reward for not performing well. For the first time, the hero has been wearing a half shirt instead of a full shirt. But there was no structural change in the hero’s body. The makers have claimed that where the budget growth has always been 12-13 percent, this time it is only 4.5 percent. But the deficit increased to over 8 percent. Budget deficits are always inflationary. The current budget has not decreased. But some cuts have been made in the development budget. But inflationary factors such as wastage, theft, inefficiency and cost overruns will remain the same. If the waste of government money and corruption cannot be reduced even with the Purity Award, then how will the budget reduce the price of goods?

Whether the government calls the budget contractionary or growth oriented, it does not matter. Everyone from common sellers to hoarders hiked the prices of goods immediately after the budget. This is expected inflation. There is no need to have any money supply influence behind it. Economists Edmund Phelps and Milton Friedman cited the oil crisis of the 1970s as an example of inflation. The oil crisis causes commodity prices to rise, which in turn increases supply-side costs. But in addition, the price may increase due to fear or greed. The economy of Bangladesh is going through a crisis period. There is a dollar crisis. Hence, these lead to an upward push in commodity prices immediately after the Budget. So, the budget never reduces inflation.

In addition to these expected factors, there is inertia or rigidity in downward movement of prices, which is called sticky price or rigid price in textbooks. As easily as the shopkeeper raises the price, he never lowers the price easily. Supply does not decrease even when it returns to normal. Wages in the agricultural sector fluctuate. But in the service and industrial sectors, wages do not decrease, prices do not decrease. This reluctance to lower prices, as invented by John Maynard Keynes, helps keep inflation high in the Bangladeshi economy, as the service and industrial sectors account for 85 percent of GDP. When the budget increases the salaries of government employees and does not cut them, the news is with the shopkeeper. He knows that even if the price goes up, the salaried people will buy things. The government will reduce the source tax on daily commodities. But it is only a sheep in the sea.

If policymakers are truly serious about reducing inflation, fiscal and monetary policy must work together. To do that, the steps that need to be taken in concert are:

1) Direct income tax should be increased for rich groups. It is the main effective method of fiscal tightening. More importantly, they will be followed up by listing who paid how much.

2) Taxes on industries and corporations should be increased. Besides, the higher profit areas should be identified and taxes should be increased there.

3) Recovery of defaulted loans should be increased. The trick of turning defaulted loans into regular loans should be stopped. A punitive tax should be imposed on defaulters until they exonerate themselves.

4) Deficit should be brought down to at least 25 percent of the budget by keeping the development budget more limited. At present it is 32 percent which has to be offset against personal loans.

5) Initiatives should be taken to bring back looted and smuggled currency by stopping the dishonest practice of laundering black money. In this case, the government can pull the media in a more responsible role than its intelligence agencies.

6) Instant currency printing should be banned forever to deal with fiscal deficit. Fiscal responsibility laws like other countries should be enacted which says that the banking sector cannot be forced to meet deficits at any time.

7) In order to expeditiously prosecute tax evasion and defaulters, a separate law commission should be constituted under the Chief Justice.

Although the main objective of inflation control is stated on the face, neither the allocation and allocation of the budget nor the financing of the deficit shows any healthy pace-nature or roadmap of inflation control. Without these seven measures, no budget has been able to curb inflation. Not in the future. In developing countries, structural reasons for budgets never reduce inflation. Finance ministers’ promises here are just words, not a trust field. The man in charge of inflating the economy is never a competent commander to prevent inflation. This is even more true in the case of Bangladesh.

Author is Professor of Economics at State University of New York

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…