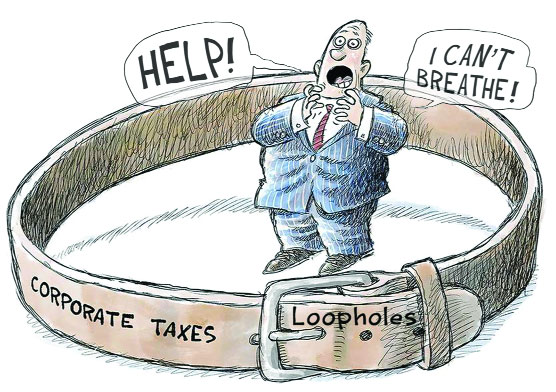

Corporate taxes in Bangladesh highest in South Asia

Below Afghanistan in collection

Zarif Mahmud: Bangladesh has the highest corporate tax rate in South Asia. But according to the research institute Center for Policy Dialogue (CPD), it is below Afghanistan. On the other hand, 2 lakh 13 thousand companies are registered in Joint Stock Company, but only 45 thousand companies have filed returns.

This information came out in the CPD’s media briefing titled ‘Tax Transparency in the Corporate Sector: Impact of Government Revenue on the Budget’ on Monday. CPD Executive Director Fahmida Khatun moderated the program. The research paper was presented by research director Khandkar Golam Moazzem.

Golam Moazzem said in the presentation, according to a 2022 report, tax evasion is causing $483 billion of tax loss in the world every year.

Of this, $312 billion at the corporate level and $171 billion at the individual level. The impact of which falls more on low-income people. Corporate tax rate has decreased globally but this rate has increased in Bangladesh. Due to this, money is being laundered abroad. He said, Bangladesh corporate tax is the highest in South Asia.

But in terms of revenue, it is below Afghanistan. Again, even if the tax rate is reduced, the amount of tax collected will always be higher, not that. It is said that the tax collection will be less in the country where the informal sector is big.

He said, CPD’s study showed that 68 percent of people do not pay income tax even after earning taxable income. In other words, two-thirds of people do not pay tax even after being eligible to pay tax. This is the major reason why the tax GDP ratio has not increased.

This is the major reason why the tax GDP ratio has not increased. On the other hand, 2 lakh 13 thousand companies are registered in Joint Stock Company, but only 45 thousand companies have filed returns.

Golam Moazzem said, the size of the informal sector in Bangladesh is 30 percent. The amount of tax in the informal sector was Tk 22 thousand crore in 2010, which increased to Tk 84 thousand crore in 2021. The shadow economy is incurring a tax loss of Tk 84,000 crore, which is about 30 percent of the GDP.

If this money were available then the expenditure on social security sector could be tripled. In other words, the main obstacle to the growth of Cornet is the informal sector.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…