Five Islamic banks facing Tk 24,000cr liquidity deficit

Staff Correspondent : Five Shariah-based Islamic banks showed positive end-of-year current accounts with ‘special loans’ from the central bank. At the end of the loan period, these banks again fell into deficit. The banks are – Islami Bank Bangladesh, Social Islami, First Security Islami, Global Islami and Union.

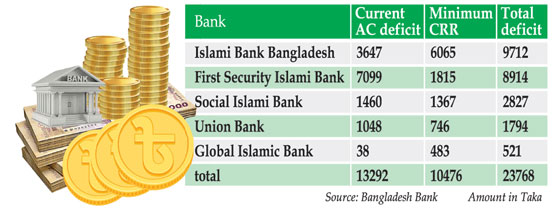

Last Thursday, the banks had a deficit of about Tk 24 thousand crore. Out of this, the deficit due to Statutory Liquidity Reserve (CRR) is Tk 10,476 crore. And the negative status of the current account of the central bank stands at Tk 13,292 crores. This information is known from the sources of the central bank and related banks.

If the current account deficit is not met, a letter was issued warning these banks to stop their transactions with other banks from December 26. Later, the central bank held a press conference and said that the final decision to stop the transactions of these banks has not been made.

After this, the central bank gave ‘special loans’ without any instruments on the last working day of the year, December 28, to make the annual reports of the five banks look good. A total of 9 banks including 5 Islami were given Tk 22 thousand crore that day. Earlier, on the last working day of 2022, the central bank had given Tk 13,790 crores to 5 Islami Bank as ‘lender of the last resort’.

It is known that due to various irregularities, extreme liquidity crisis occurred in these banks from the end of 2022. Even though the crisis intensified day by day, no effective action was taken against the banks. Banks have not been able to maintain statutory cash reserve (CRR) and statutory liquidity (SLR) for many days. There is no condition to pay fine for this. Different instruments are required to borrow from other banks. In absence of that, five Islamic banks are running with ‘special loans’ and negative current accounts from the central bank.

Bangladesh Bank Spokesperson and Executive Director Md. Mejbaul Haque told that although there is a deficit in the current account of the central bank, the transactions of these banks with other banks have not been stopped. But the shortfall did make some adjustments. The latest status of the banks is not known. But work is going on in this regard.

What is deficit of any bank?

According to Bangladesh Bank, against a deposit of Tk 100 in a bank, Tk 4 has to be kept as CRR in the central bank. If a bank fails to do so, it has to pay a penalty of 9 percent on the unearned portion. Although the CRR and SLR of the bank have been short at various times, the current account of the central bank has not been negative for a long time. First Security Islami Bank could not meet the shortfall despite the special loan for three days on December 28. At the end of last December, the total deficit of the bank was Tk 4,872 crores. And on the first day of the year, January 1, the deficit increased to Tk 7,579 crore. Last Thursday it increased to Tk 8,914 crores. Of this, the current account of the central bank is negative by Tk 7,099 crores. And Tk 1,815 crore CRR was supposed to be kept, but could not keep even one rupee. The other four banks managed to show marginal CRR and current account surpluses at the end of December due to special lending. However, a large deficit has been shown since January 1, the day after the loan period expired on December 31.

According to the data of Bangladesh Bank, the total deficit of Islami Bank Bangladesh was Tk 9,712 crore last Thursday. Out of this current account is negative Tk 3,647 crores and CRR Tk 6,065 crores. Last January 1, the deficit of the bank was Tk 5,893 crores.

Last Thursday, Social Islami Bank’s current account deficit was Tk 1,460 crore out of a total deficit of Tk 2,827 crore. The remaining Tk 1,367 crores is due to CRR. Last January 1, the total deficit of the bank was Tk 1,835 crores.

Out of the total deficit of Tk 1,793 crore in Union Bank, Tk 1,480 crore is negative current account and Tk 746 crore is deficit due to CRR. On January 1, the total deficit was Tk 1,409 crore. Last Thursday, out of the total deficit of Tk 521 crore of Global Islami Bank, Tk 483 crore CRR and Tk 38 crore current account were negative. On January 1, the total deficit of the bank was Tk 430 crore.

The Managing Director (MD) of the five Islami banks were contacted for a statement on the overall issue, but there was no response. Among them, the MD of one of the banks did not agree to comment on the matter for the time being.

Those concerned said that financial reports of banks are prepared on the basis of December 31 data. Loans have been given in this way so that the financial report does not have to reflect various bad conditions including current account deficit, CRR deficit of the central bank. In this way, if the deficit adjustment is not given, all types of expenses including LC confirmation charges of the banks will increase further. Although this is the case in recent times, Islami Bank Bangladesh used to lend regularly to other Shariah-based banks.

How is current account deficit?

Every bank has a current account with the Motijheel office of Bangladesh Bank. All transactions including CRR, SLR storage of the bank, settlement of inter-bank transactions and refinancing from the central bank are settled from this account. According to the existing rules, if there is no money in the current account of a bank, the transaction will not take place – this is normal. But there is no chance for it to be negative month after month. However, the accounts of five Shariah-based banks have been negative for a long time, but transactions continue. Bangladesh Bank issued a warning letter to the MDs of five banks on November 28 after several rounds of verbal warnings as the deficit situation has gone to an abnormal level.

Bangladesh Bank’s letter says, ‘interbank transactions are settled through your current account kept at Motijheel office. Your current account balance has been negative for a long time, which is not in line with normal banking practices. The matter has been repeatedly brought to your notice but no significant action has been taken. In this situation, if the negative status of the current account cannot be adjusted within 20 working days of receiving the letter, i.e. 26 December, it will be blocked from all or any specific clearing platform.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…