Foreign loan interest rate increasing

China-Russia set tough terms

Zarif Mahmud : The foreign debt of the government has been increasing rapidly for several years. Among these are China, Russia’s tough terms and high interest loans. Due to these loans, the average interest rate of the government’s foreign debt repayment is increasing. Interest rates on foreign loans have doubled in the last four years. Besides, there are service charges on China’s loans. In addition, China and Russia have relatively short repayment periods. These loans have to be repaid in 15-20 years. As a result, the amount of foreign debt repayment of the government has increased overall.

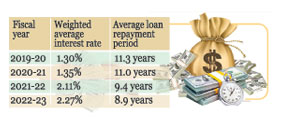

This information has emerged in the latest report of the Economic Relations Department (ERD). It can be seen that the weighted average interest rate of foreign debt of the government for the fiscal year 2019-20 was 1.30 percent.

In the next financial year, it increased slightly to 1.35 percent. In the fiscal year 2021-22, the interest rate increased by 2.11 percent and in the fiscal year 2022-23 by 2.27 percent.

Meanwhile, the average duration of foreign debt repayment of the government in the fiscal year 2019-20 was 11.3 years. In the next fiscal year, it slightly decreased to 11 years. In FY 2021-22, the repayment period further decreased to 9.4 percent and FY 2022-23 to 8.9 years. That is, along with the increase in the interest rate, the repayment period has also decreased by two and a half years. Increase in interest rates and shortening of tenure have affected loan repayments.

According to ERD data, the government’s debt repayments (principal and interest) last fiscal year stood at $4.779 billion. In the previous financial year, the amount was $3.610 billion. That is, last fiscal year, foreign debt repayment increased by $1.169 billion or 32.38 percent. In the last fiscal year, the actual debt repayment was $3.473 billion, which was $2.954 billion in the previous fiscal year. Accordingly, the actual payment increased by $519 million or 17.57 percent.

On the other hand, last financial year the government had to pay interest on foreign debt of $1.306 billion. The amount for fiscal year 2021-22 was $656 million. In other words, the interest payment cost has almost doubled in the space of one year. According to ERD, the government’s debt servicing (debt servicing) was 5.15 percent of revenue in FY 2021-22. Last financial year it increased to 7.13 percent.

Those concerned say that one of the reasons for the increase in the average interest rate of foreign loans is the tough conditions of loans from China and Russia. Among these, most of China’s loans have an interest rate of two to three percent. Along with this, there is a service charge of 20 to 25 percent. Its repayment period is 15 years, of which the grace period is only four years.

Interest rates on Russian loans are six-month LIBR+1.75 percent. Currently the six-month LIBER rate (London Interbank Offered Rate) is 5.60 percent. In this, the interest rate of Russia’s debt stands at 7.35 percent. The repayment period of this loan is 20 years, out of which the grace period is 10 years.

Incidentally, in the financial year 2021-22, the amount of foreign debt repayment was 4.59 percent of Bangladesh’s export earnings. But last financial year it increased to 5.81 percent. However, ERD believes that this rate is still far below the risk level.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…