Industrial sector increasingabnormal defaulted loans

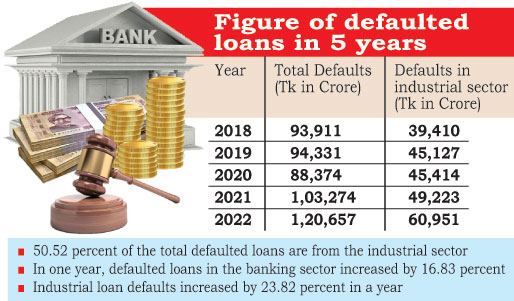

Zarif Mahmud: Even during the financial crisis, commercial banks are increasing the disbursement of loans to the industrial sector. But most of those loans are not being recovered. As a result, it is defaulting. Defaults in industrial loans have increased at a comparatively higher rate than overall bank loans. In one year till last December, defaulted loans in the banking sector increased by 16.83 percent to Tk 120,656 crore. At the same time, defaults in industrial loans increased by 23.82 percent.

Tk 17,383 crores of defaulted loans have increased in the entire banking system in the last one year; Out of this 67.50 percent is industrial loans. This is said to have happened because the large loans disbursed through irregularities and frauds at various times belong to the industrial sector. This information is known from the sources of Bangladesh Bank.

According to the latest data of Bangladesh Bank, the total credit status in the industrial sector till December 2022 stands at Tk 730,825 crore. Of this, Tk 60,951 crores have become defaulters; Which is 8.34 percent of the loans distributed in this sector. Out of the Tk 14 lakh 77 thousand 788 crore loans of the entire banking sector where defaults are 8.16 percent, currently 50.52 percent of the total defaulted loans in the banking sector are in the industrial sector.

Those concerned say that proper rules are not being followed in the disbursement of loans in the industrial sector. As a result, defaulted loans are increasing. Large industries are getting loans in turn. In many cases, they do not return the bank money because they are politically influential. And some are taking out money from the bank anonymously and smuggling it abroad. Usually, these funds are not returned. As a result, defaulted loans are increasing in this sector.

According to the latest report of Bangladesh Bank, up to December last year, the loan disbursed to the industrial sector was Tk 1 lakh 49 thousand 669 crore, which was Tk 1 lakh 24 thousand 865 crore during the same period of last year 2021. According to that, industrial debt increased by Tk 24,804 crore or 19.87 percent in one year.

Bankers say that due to the Russia-Ukraine war, prices of all types of products, including oil and gas, have increased abnormally since February last year. Besides, the dollar has increased by at least 25 percent compared to the last year, resulting in an overall increase in industrial loans.

In this regard, the managing director of a private bank said, we have had a simple monitoring policy since Covid; In addition, due to low loan interest, industrial sector loan growth has increased.

He further said that the import volume is decreasing throughout the fiscal year 2022-23. However, due to the increase in the price of the product, the additional import bill has to be paid. As a result, the debt also increased.

Meanwhile, with the increase in the disbursement of industrial loans, the recovery has also increased. Till December last year, the collection has increased by 54.63 percent. Bangladesh Bank’s report also shows that till December last year, debt collection in the industrial sector stood at Tk 1 lakh 57 thousand 683 crores, which was Tk 1 lakh 1 thousand 972 crores a year ago.

According to the report of Bangladesh Bank, out of disbursed industrial loans, Tk 730,825 crore is outstanding. This figure is 5.70 percent compared to the same period of the previous year. At the end of December 2021, the outstanding was Tk 6 lakh 91 thousand 395 crore. Among the loans disbursed to the industrial sector, the overdue figure was Tk 93,813 crore, which was Tk 95,946 crore in December of the previous year.

Out of disbursed industrial loans, Tk one lakh 19 thousand crores have been disbursed to large industries. Tk 11,749 crores have been distributed to medium industries and Tk 18,842 crores to small industries. Out of this, Tk 29,574 crores of term loans have been disbursed. And the current capital distributed is one lakh Tk 20,095 crores.

The former chief economist of World Bank’s Dhaka office regarding the increase in defaulted loans in the industrial sector. Zahid Hossain said that the rate of defaulted loans is higher for large companies than small companies in the industrial sector. Because big institutions are re-borrowing even after default. Therefore, the rate of defaulted loans has increased in this sector. Besides, due to rescheduling and restructuring facilities, distressed loans in this sector are much higher than bad loans.

He also said that there are defaulters with state-owned enterprises as well as big industrial enterprises. They are out of touch. Those who are out of touch should stop giving new loans. It must be ensured that new loans do not arise. Then the defaulted loans in this sector will decrease.

According to the rules of Bangladesh Bank, in case of default, no new loan is allowed. However, Bangladesh Bank has recently shown a liberal policy by leaving the power of rescheduling to the bank’s board of directors. This will increase rather than decrease defaults. Besides, defaulted loans are not being recovered due to weak legal process. Because of this, banks are not interested in legal proceedings. So, this process should be made easier. And if the legal process becomes easier, the collection of defaulted loans will increase.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…