Merger of City Bank and Basic Bank

Shareholder’s statement

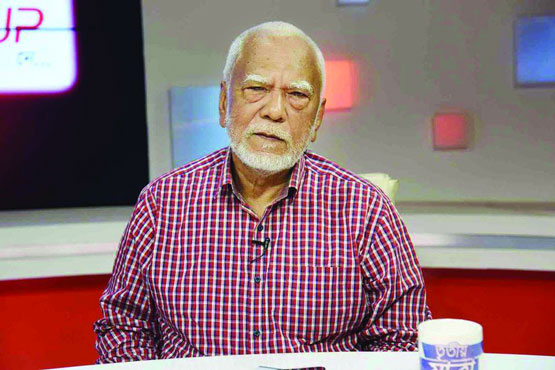

Prof. Abu Ahmed: I am a small shareholder of City Bank. I have been a shareholder of this bank for more than a century. A few years ago, when IFC, the investment wing of the World Bank, bought the shares of the bank and became a management partner as a board member, I, like others, gained confidence in the bank. IFC apparently bought the shares at Tk 28.

At that time, the share price of the bank was between Tk 30-35. However, even after the arrival of IFC, we did not see much financial success of the bank. In the year just ended (ending December 2023) alone, City Bank has done well in financial indicators. A few days ago, the top executive of the bank came on the digital platform of a media and talked a lot about the success of the bank in a very cheerful mood. As I have interest and reason to know about the financial condition of this bank, I listened to his entire speech. I am happy to hear as a small shareholder. I thought the bad condition of City Bank has gone by now. Only bright future ahead.

Citibank has also announced good profits for shareholders for the financial year 2023. 15 percent cash and 10 percent stock. It is the highest profit announcement in many years. The price of this share in the market increased by 1 (one) taka and each share was being traded between Tk 23 and Tk 23.10. Many people thought about selling other shares and I bought some more shares of City Bank at this price. A 25 percent profit-paying share was available at just Tk 23. In any case, the stock seemed cheap to me. I myself am a teacher of valuation. In any context, the stock looked cheap. Besides, one of the speeches given by the top executive that day was that there are wise people on the board of this bank, who do not interfere in the bank management. There is also a representative of the World Bank as a member of the banks board meeting. He also said that the board members themselves think that paying good profits is enough to protect their interests. These statements have left a mark on the minds of outside shareholders like us. In fact, all shareholders at the end of the day want to pay good profits. I feel that Citibank was bad in the past but not bad now. The management of this bank can be trusted.

But unfortunately, just two or three days after those statements, a news came out in the media which was not taken well by the stock investors. The news is that City Bank is going to acquire the ailing Basic Bank. When a failed bank merges with a good bank, many would naturally assume that eventually some of the bad banks bad will seep into the strong bank and weaken it as well. From that idea, the share price of City Bank decreased by 60 paisa to Tk 22.40 in the market that day. I myself am disappointed and disheartened to think that if such news comes to the market, the impact on the share price of City Bank, has the bank management ever thought? The main objective of the management of any publicly traded company is to maximize shareholder value.

There should have been an explanation of how the merger of Basic Bank with City Bank would benefit the shareholders of City Bank. City Bank management may say that the time for an explanation has not yet come. The matter is at a very early stage. Banks are merging in many countries around the world. Somewhere acquisition is also done by buying assets. In this case, what we understood from the outside is that after abolishing the bolts and management of Basic Bank, City Bank will manage this bank subject to compliance of conditions for a few years. Later, when the financial condition of this bank improves, the merger will be done. Then valuation of Basic Banks assets will be done by the valuer and possibly additional shares of City Bank will be issued against the fixed assets in favor of the owner of Basic Bank. In this case, the owner of the basic bank is the government. In this way, if the merger actually takes place, the Bangladesh government will own a large part of City Banks shares. This will mean that the equity (paid up) capital of City Bank will increase a lot even if no stock dividend is issued. And if the business also increases a lot, then the matter may be somewhat logical. But our fear is whether the banks profit will grow at the rate at which the equity base will increase.

A bank does not need many branches to do good business. The example is right in front of us. Only a few branches of foreign standard-chartered banks. How much profit they make every year is a published matter. Compared to the capital (core capital) invested in Bangladesh by Standard Chartered, their profit per capital is much higher. Our five domestic banks are making more profit than the foreign bank alone. Then the question can be asked whether City Bank will make a good profit by acquiring many branches of a poor bank. Another question is whether Citibanks deposits will increase if the acquisition takes place. In this case, the question is whether City Bank is suffering from a drought of deposits?

People keep all the news now. Any good bank will not have deposit problem. Top ten banks in Bangladesh economy will never suffer from deposit drought. Banking business is based on trust. People keep deposits with good banks without profit. Foreign Standard Chartered Banks are getting huge deposits at very low interest rates. The real thing is trust or faith. With the growth that City Bank has achieved in the financial year 2023, this bank is also supposed to get deposits at a very low rate. So, what will be the benefit of City Bank by acquiring Basic Bank? It should not be the case that Bangladesh Bank has to jump at the request. Another question is what will happen to Basic Banks bad loans or NPLs? Assume the NPLs are bought by an asset management company of the government. But even in this case the complexity will not be solved. Citibanks shareholders would certainly not want some toxic assets to end up on Citibanks shoulders.

If a failed public bank merges with a strong private bank, the complexity will be much higher. There will be many areas of blame on this. Merger of one government bank with another government bank is very easy. Both sides are owned by the government. But the owners of City Bank and Basic Bank are different parties. There will be doubts, complications and the task will not be easy. I have thought about this a lot. I think Citibank should stay away from this merger or acquisition attempt.

Abu Ahmed: Economist and former professor and chairman of Dhaka Universitys Department of Economics

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…