Most banks meet Basel III terms

But things are not rosy

Mahfuja Mukul: Most of the banks in Bangladesh have implemented the Basel III guidelines within the deadline of 2019.

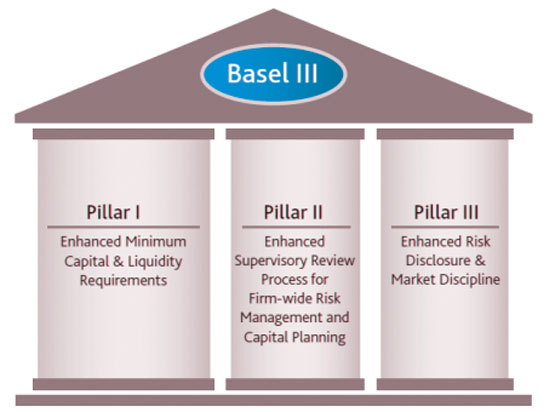

Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09 with the view to improving regulation, supervision and risk management within the banking sector.

As per a roadmap issued by the Bangladesh Bank in 2014, banks were supposed to raise their minimum capital adequacy ratio (CAR) to 12.5 per cent against their risk-weighted assets by December 2019 from the then 10 per cent.

Of the 58 banks, 43 have met the global regulatory standard within the deadline, according to data from the central bank.

On the surface, it seems like a stroke of positive development from the sector that often comes under fire for its questionable corporate governance.

But experts cautioned against rejoicing: the feat was achieved through artificial means, so the banks’ capital bases are not truly healthy.

Banks have raised their capital base by riding on the relaxed loan rescheduling policy offered by the central bank.

The policy allowed defaulters to reschedule their classified loans with a down payment of just 2 per cent of the outstanding amount instead of the existing 10-50 per cent.

The central bank also allowed banks to reschedule a large amount of defaulted loans by giving special permission on a case-to-case basis, helping the banks to improve their capital base.

Last year, a record Tk 50,186 crore was rescheduled.

Despite that, 15 banks including the eight state-run lenders failed to implement the Basel III guidelines on time.

The central bank planned to raise the CAR to 10 per cent by 2015, and from there to 10.625 per cent the following year.

From there, the CAR would be raised to 11.25 per cent in 2017, to 11.875 per cent in 2018 and 12.5 per cent in 2019.

The CAR is a measurement of a bank’s available capital expressed as a percentage of its risk-weighted credit exposures, which is used to protect depositors and promote the stability and efficiency of banks around the world.

The ratio is calculated by dividing a bank’s capital by its risk-weighted assets.

Risk-weighted assets are used to determine the minimum amount of capital that must be held by banks and other institutions to reduce risks of insolvency.

The capital requirement is based on a risk assessment for each type of bank asset.

For instance, a loan that is secured by a letter of credit is considered to be riskier and requires more capital than a mortgage loan that is secured with collateral.

Defaulted loans had not increased too much in the banking sector last year due to the central bank’s relaxed rescheduling facility along with giving special permission to regularising default loans, said Ahsan H Mansur, executive director of the Policy Research Institute.

Defaulted loans stood at Tk 94,313 crore at the end of 2019, up 0.42 per cent year-on-year.

“This has helped banks fortify their capital base. But the regulatory requirement has been fulfilled by way of a window dressing of banks’ financial health in order to paint a rosy picture.”

Risk-weighted assets decline when defaulted loans turn into unclassified loans, which narrows the requirement for capital, he said.

Besides, the requirement for provisioning also comes down due to the unclassified loans, giving a boost to the capital base as well, said Mansur, also a former official of the International Monetary Fund.

Rescheduled loans have frequently entered into the defaulted zone in recent years, creating a worrisome situation in the financial sector as a whole.

The BB data showed that Tk 13,284 crore of the soured loans, regularised last year, has become defaulted. This means nearly one-fourth of the rescheduled loans turned bad again.

Banks will have to recover their defaulted loans and ensure corporate governance to improve their capital base, said Mansur, also the chairman of Brac Bank.

If they fail to do so, the banking sector will be mired in large capital shortfall in the days ahead, he added.

The rampant rescheduling facility enjoyed by banks has helped raise their capital.

“But some banks including state run lenders even failed to increase their capital despite enjoying the facilities,” Khaled added.

The banking sector, however, did not raise their CAR as per the Basel III guidelines because of the failure of the 15 banks.

As of December, last year, banks maintained a CAR of 11.57 per cent, which is much lower than the regulatory limit of 12.50 per cent.

The CAR of foreign banks is 24.45 per cent, private banks’ 13.62 per cent and state banks’ 4.99 per cent, according to data from the BB.

This is a good sign that the majority of the banks fulfilled the Basel III requirement, said Md Arfan Ali, ex-managing director of Bank Asia.

All banks had taken a master plan five years ago to implement the Basel III, which helped them to strengthen their capital base.

Some banks had also issued bonds to mobilise their fund in recent period, which had a positive impact on their capital.

Many foreign banks shy away from doing business with their counterparts if their capital base is not strengthened in line with the global requirement, according to Ali.

“My bank has selected good clients, who have managed good rating from credit rating agencies, for the disbursement of loans. Banks’ requirement of capital is reduced if strong rated clients can be managed.”

Banks will be able to calculate a lower amount of risk-weighted assets if they disburse loans to the high-rated clients, Ali said.

He also acknowledged that the lower requirement for provisioning against the default loans had also helped lenders strengthen their capital base last year.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…