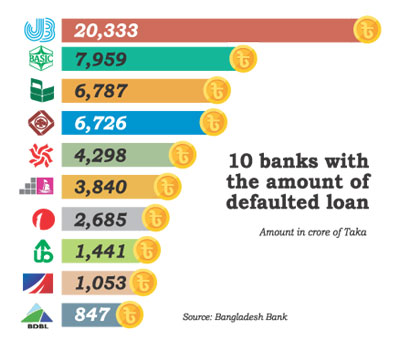

10 banks top on defaulted loan

Janata Bank among top 10 defaulters

Golam Mostafa Jibon: Country’s 10 banks including state-owned and private have now remained on top position for defaulted loans.

The sum of defaulted loans in banks and financial institutions is increasing by leaps and bounds. In this situation, 10 banks are inflicted with the largest portion of defaulted loans. Of them, the state-owned Janata Bank among the scheduled banks of the country has the highest number of non-performing loans.

At the end of September this year, the amount of defaulted loans in the bank stood at Tk 20,333 crores. However, the rate of non-performing loans is highest in the foreign sector National Bank of Pakistan. About 97.90 percent of the loans disbursed by the bank are in default. However, the private sector National Bank has risen to the top in terms of increase in defaulted loans in July-September. The state-owned Janata Bank is next to National Bank in terms of increase in defaulted loans, Bangladesh Bank’s latest report revealed the information.

Anontex, Crescent, Noor Jahan and other groups have grabbed more than Tk 11,000 crore from Janata Bank, which is among the top ten defaulters. At present, 27.83 percent of the bank’s total loans have defaulted. In other words, Janata Bank’s defaulted loans have increased by Tk 6,502 crores in the last one year.

On the other hand, Agrani Bank’s defaulted loans increased by Tk 4,315 crores. Apart from this, Rupali Bank’s defaulted loans have increased by Tk 2,892 crore.

According to Central Bank data, ICB Islamic Bank (formerly Oriental) is second in terms of high default rate. More than 83 percent of the loans disbursed by this bank are defaulters.

In 2006, the unlimited loan scam happened in this Oriental Bank. Many of the depositors of this bank are yet to get their money back. The default rate of Padma Bank (formerly Farmers Bank) is around 67 percent. Tk 3,840 crore out of distributedTk 5,843 crore by the bank is in default.

The amount of defaulted loans of Basic Bank, which is in the top ten list, is Tk 7,959 crores or 58.62 percent. About Tk 4,500 crore were looted from this bank.

Incidentally, there have been major loan scams in the country’s banking sector for the past decade. Notable among these are: Hallmark, Bismillah, Anontex, Crescent, SA Group, Noorjahan, Alltex, Sunmoon Group and Basic Bank loan scams.

In these cases, including interest, has exceeded Tk 30,000 crore. All of it is now in default. Sonali Bank, which is among the top ten defaulters, had defaulted loans at the end of September at Tk 12,444 crores or 17.18 percent. Besides, Agrani Bank’s defaulted loans stood at Tk 12,186 crore or 19.28 percent at the end of September.

Bangladesh Development Bank (BDBL) has defaulted loans amounting to Tk 847 crore in September, which is 40.72 percent of the total disbursed amount.

State-owned Rupali Bank’s defaulted debt is Tk 6,726 crore or 17.58 percent. Specialized Rajshahi Agricultural Development Bank and Bangladesh Agricultural Bank have also more defaulted loans.

At the end of last September, the defaulted loans of these two banks stood at 9.27 percent and 21.49 percent respectively.

Prabasi Kalyan Bank, another bank in this sector, defaulted on 13.43 percent of its loans. The defaulting loan situation of the private sector National Bank is getting worse day by day. The defaulted loan stood at Tk 11,336 crores or 27.46 percent on last September. A year ago, it was Tk 4,588 crores. In one year, the defaulted loans of the bank increased by Tk 6,747 crores.

According to the data of the Central Bank, the defaulted loans in the banking sector have increased by Tk 33,000 crores in the last one year. At the end of last September, defaulted loans increased to Tk 1,34,396 crores. In September last year, defaulted loans in the banking sector were Tk 1,01,150 crore. At the end of last June, defaulted loans was Tk 1,25,257 crores. That is, defaulted loans increased by Tk 9,139 crores in three months.

However, during a recent visit to Bangladesh, the International Monetary Fund-IMF delegation asked to know the initiatives and plans to reduce the high non-performing loans creating a serious risk in the banking sector.

According to the data of the Central Bank, at the end of last September, the total loan amount of the banking sector stood at Tk 14,36,000 crores. Of them, 9.36 percent of the total loans were defaulted. Out of this, the amount of defaulted loans of state-owned banks is Tk 60,502 crores. The defaulted loans of private banks are Tk 66,695 crores, while Tk 2,970 crores in foreign banks and Tk 4,277 crores in specialized banks.

Among other banks with high defaulted loans-Bangladesh Commerce Bank defaulted Tk 1,53 crore or 45.42 percent, AB Bank defaulted Tk 4,298 crore or 14.11 percent, One Bank defaulted Tk 2,685 crore or 11 99.99 percent and the defaulted loan of Uttara Bank is Tk 1,441 crores or 9.52 percent.

Apart from this, foreign sector Habib Bank’s defaulted loans have exceeded 12 percent.

Bangladesh Bank’s former Governor Dr. Salehuddin Ahmed said that, it is worrisome, if the defaulted debt is more than 5 percent. Therefore, it is now necessary to take effective measures to reduce defaulted loans.

He pointed out that due to concessions by the central bank, defaulted loans have increased.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…