$14 b hard loan places BD in serious crisis

Power sector

Mahfuja Mukul: About $14 billion hard term loan borrowed for the power sector has become a big challenge for Bangladesh to repay on time. Moreover, the interest rate has increased almost 3 percent than the time of borrowing. These have created one kind of uncertainty in timely payment because the payments will be in dollar.

Several government projects have been taken up in the power sector in the last few years. However, most of the projects have been implemented on stringent terms of Buyers Credit or ECA (Export Credit Agency) loans. These loans are to be repaid in 12-15 years with grace period. And the interest rate was six-month Libor (London Interbank Offer Rate) plus 3-4 percent.

Libor was abolished on June 30. As a result, the interest for these loans will be six months SOFOR (Secured Overnight Financing Rate) plus 3-4 percent. However, the Libor rate at the time of taking the loan was only 0.3 to 0.5 percent. Even a year and a half ago, 3.5 to 4.5 percent interest had to be paid for these loans. But currently Sofar is 5.3 percent. And the six-month SOFAR is 4.98 percent. That is, the interest rate of ECA loan will be 8 to 9 percent.

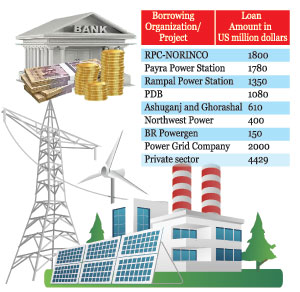

According to the data, currently the power sector has hard debt of around $14 billion. Among them, RPCL-Norinco International Power Company has taken a loan of about $1800 million for the Patuakhali power plant. Bangladesh-China Power Company Limited’s Payra power plant loan amount is $1,780 million and Bangladesh-India Friendship Power Company’s Rampal power plant’s loan amount is $1,350 million.

Apart from this, the ECA loan for eight projects of Power Development Board (PDB) is $180 million, $ 610 million for Ashuganj and Ghorashal power plants, $400 million for Northwest Power Generation Company and $150 million for BR Powergen. In addition, the power grid company has taken a loan from foreign sources for the construction of transmission lines, about $2,000 million. And the debt of various private power plants is $4,429 million.

It has been found that the loans of various government agencies and domestic-foreign joint investment companies were guaranteed by the government of Bangladesh. As a result, the interest rate on these loans is 6 months Libor plus (on average) 3 percent. Libor was 0.31 percent in December 2021. On average, the interest on these loans was 3.31 percent. However, currently the six-month SOFA stands at around 5 percent. As a result, the loan interest rate has increased to an average of about 8 percent.

On the other hand, the interest rate is high as there is no guarantee in private loans. The average interest rate of these loans to the private power sector was Libor plus 4-4.5 percent. As a result, the interest rate for private loans used to be 4.31 to 4.81 percent. However, due to the high rate of six-month SOFAR, the interest rate has gone up to 9.5 percent. In this, both the public and private sectors are in trouble with the interest payment of ECA and Buyer’s Credit.

PDB officials said that capacity payments will also increase due to high interest rates in government projects. On the condition of anonymity, several officials of the organization said that the interest rate of Payra power plant loan was six months LIBOR plus 2.85 percent. And the Libor at the time of taking the loan was 0.5 percent. Now the six-month SOFR is around five percent. In this, the interest rate for Payra power plant loan which was initially 3.35 percent, now stands at 7.85 percent. And this interest rate is related to Payra power plant capacity charge. So, the capacity charge will also increase.

According to the information, the ECA loans of the power sector are to be repaid in an average of 12 years. It has to pay about $1,140 million a year. Of this, about $770 million in the public sector and $370 million in the private sector have to be paid. And about $745 million for public sector interest and $400 million for private sector interest. In all, about $2.2 billion must be paid annually.

However, the loan installments can’t be paid regularly due to the dollar crisis. Several such incidents have occurred in the past few months. Several senior officials of PDB said that the government has taken up various projects by giving priority to the power sector. Several power plants have also been approved in the private sector. But repayment of these power plant loans has become a tough challenge. Because on the one hand the interest rate has increased, on the other hand the dollar crisis has become evident. In this way, if the payment of regular installments is delayed, there is a danger of tarnishing the image of the country.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…