8 banks failed to keep provisions

Deficit of 4SoBs Tk 11696 cr Private banks Tk 8137 cr

Mahfuja Mukul: Banks are giving special discounts for businessmen in repayment of loans. Exemption has not yet expired. As a result, customers are exempted from defaulting even if they do not fully pay the loan installments. However, the defaulted loans of the banking sector are not decreasing. On the contrary, it is increasing at an alarming rate. At the end of September this year, the amount of defaulted loans has increased to Tk 1 lakh 33 thousand 396 crore 11 lakh. As a result, the banking sector is at high risk.

According to international standards, the default loan rate is maximum 3 percent tolerable. The default rate in the country is more than 9 percent. At least eight public and private sector banks failed to keep provisions against classified loans at the same time. The provision deficit of the banks stoodd at around Tk 20 thousand crore. The information that has emerged in the latest report of Bangladesh Bank.

As per the central bank rules, the bank has to keep provisioning at the rate of 0.25 to 5 percent against unclassified or regular loans. 20 percent to be kept against low (sub-standard) loans. And there is a rule to keep 50 percent provision against doubtful loans. One hundred percent (100 percent) provision has to be kept against bad and loss loans.

Considering the quality of all types of loans distributed by public and private banks, a certain amount of money has to be deposited as a security reserve (provision). There is a provision to keep a provision so that the bank is not at financial risk if a loan eventually turns into a bad loan.

According to Bangladesh Bank, eight banks have failed to keep the required provision at the end of September this year. Among these banks are state-owned Agrani Bank Limited, Basic Bank Limited, Janata Bank Limited, Rupali Bank Limited. Private sector banks include Bangladesh Commerce Bank Limited, Mutual Trust Bank Limited, National Bank Limited and Standard Bank Limited. The provision deficit of these banks is more than Tk 19 thousand 833 crore.

However, the overall deficit in the banking sector has been slightly reduced as several banks kept more money as provisions than required. In this case, at the end of September, the amount of provision deficit in the entire banking sector is Tk 13 thousand 529 crore 55 lakh. Earlier, 9 banks failed to maintain provisions at the end of June quarter. The provision deficit of those 9 banks was Tk 18 thousand 931 crore 95 lakh.

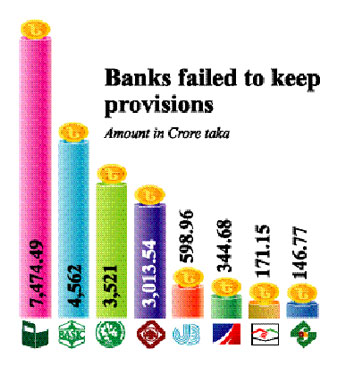

Among the eight banks with provision deficit, four state-owned banks have a provision deficit of Tk 11,696 crore. Among the state-owned banks, Basic Bank has the largest deficit. At the end of September, the provision deficit of this bank, which is in an extremely fragile state, stood at 4 thousand 562 crores. Next is the state-owned Agrani Bank Limited. Agrani Bank’s provision deficit is Tk 3,521 crore.

Besides, the provision deficit of Rupali Bank Limited is Tk 3 thousand 13 crore 54 lakh, the provision deficit of Janata Bank is Tk 598 crore 96 lakh.

Four private sector banks failed to maintain provisions. The deficit of these banks is Tk 8 thousand 137 crore. National Bank Limited has the highest provision deficit among private banks. The amount of provision deficit of this bank is Tk 7 thousand 474 crore 49 lakh. Bangladesh Commerce Bank, which is in the second position, has a deficit of Tk 344 crore 68 lakh, Mutual Trust Bank has a deficit of Tk 171 crore 15 lakh, Standard Bank has a provision deficit of Tk 146 crore 77 lakh.

At the end of the current September 2022, the need to keep provisions in the banking sector was Tk 88 thousand 683 crore 28 lakh. Tk 75 thousand 153 crore 73 lakh has been kept there. As a result, the overall safety reserve deficit is Tk 13 thousand 529 crore.

At the end of June this year, the amount of defaulted loans in the banking sector was Tk 1 lakh 25 thousand 257 crore. Accordingly, defaulted loans increased by Tk 9 thousand 139 crore in three months. At the same time last year (September 2021), the amount of defaulted loans was Tk 1 lakh 1 thousand 150 crore. According to the calculations, the amount of defaulted loans has increased by Tk 33 thousand 246 crore in the space of one year.

Bank and financial sector analyst and former governor of Bangladesh Bank economist Dr. Saleh Uddin Ahmed said, “Many wrong decisions come from the central bank now.” Those policies further encourage defaulters. Conversely, good quality customers are discouraged from repaying their loans. Banks are also reluctant to recover defaulted loans. The central bank does not have to be accountable for these things.

The former governor added, “The policies of the central bank should be long-lasting. So that defaulted loans, rescheduling, provision shortfalls in banks come down. Banking Commission should be formed to solve these problems. Even before this, the loan default problem has been solved through the commission.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…