Bangladesh becomes major client of Acu

Staff Correspondent : Although there are nine member countries of the Asian Clearing Union (ACU), the settlement system remains centered only on India-Bangladesh. 91 percent of transactions are between these two countries through the inter-regional settlement system. In this case the main creditor country is India. And the top debt burdened Bangladesh.

Every month, the transaction information of the member countries is published by Acu. According to the company’s latest numbers, a total of $798.3 million was transacted through Acu last January. Of this, India was in a debt or credit position of $73.12 million, which is 91.60 percent of the total credit. At the end of January, Bangladesh was in a debt position of $72.1 million, which is 90.32 percent of the total debit. Of this, India owed $67.63 million.

Generally, in case of import-export liability is payable immediately on opening or settlement of Letter of Credit (LC). But transactions through Acu are settled every two months. However, even in this case, the full amount of the transaction does not have to be paid.

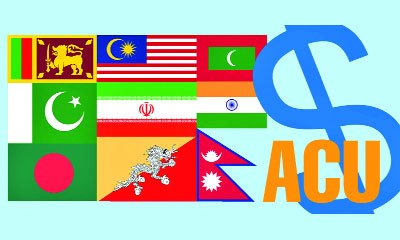

Only the liability remaining after reconciling the import receipts with the export earnings has to be paid. Bangladesh, India, Pakistan, Iran, Sri Lanka, Myanmar, Nepal, Bhutan and Maldives-the central banks of nine countries in Asia are members of Acu. Among them, Sri Lanka’s membership was suspended last year due to financial insolvency. And due to the sanctions of the West, including the United States, transactions with Iran through Akur are closed.

Among ACU member countries, the largest trade is between Bangladesh and India. According to the data of the Ministry of Industry and Commerce of India, the trade volume of these two neighboring countries was $14.23 billion in the financial year 2022-23. However, in this trade, Bangladesh has imported products worth $12.21 billion. And at the same time Bangladesh’s export to India was only $2.02 billion worth of goods. Before this, Bangladesh-India trade was 18.13 billion dollars in 2021-22 financial year. Bangladesh imported goods worth $16.15 billion in this trade. It is this huge trade deficit between the two countries that sustains Acu’s need. Even if direct transactions with India in rupees have been started, it will take a long time to be recognized as an effective system, said those concerned.

Bangladesh Bank executive director and spokesperson Majbaul Haque told, “Even if transactions are started in rupees, there will be a need for Acu.” Because the export of Bangladesh to India is like $2 billion. In contrast, we import more than $10 billion worth of goods from India. As a result, even if transactions in rupees are fully operational, the need for Acu will not be exhausted soon. In this system, the liability is paid every two months. And being in debt, Bangladesh gets additional benefits in this case.

After reviewing Aku’s data, it can be seen that the net debt after settlement of transactions through Acu last January was $75.19 million. Bangladesh, Maldives and Nepal were in the list of debt burdened countries. And India, Pakistan, Bhutan and Myanmar were in the list of creditors. Of the total debt, $69.96 million belonged to Bangladesh. After settlement of the transaction, India’s net debt was $723.6 million.

Bangladesh Bank has paid the accrual debt for the first two months of this year i.e. January and February last week. According to data from the country’s banking sector regulator, $1.35 billion has been repaid over the past two months. After paying this debt, according to international standards (BPM6), the country’s foreign exchange reserves were $20.62 billion.

India and Bangladesh started trading in rupees on July 11 last year to reduce dependence on the dollar. At that time, it was said that the dollar crisis will reduce if the transaction starts in rupees. Businessmen of Bangladesh will also benefit a lot. However, traders have not shown much interest in trading in rupees so far. According to Bangladesh Bank sources, the transaction of 1 crore dollars has not been settled in rupees since the beginning.

Bank executives say that it is only possible to open import LCs in Indian currency only if the bank has enough rupees. But no such bank has Rupee. Because in order to have rupees, Bangladesh has to export goods in this currency. Bangladeshi companies that export products to India are looking to get prices in dollars. Due to this, even if the importers want to, it is not possible to import goods from India in rupees.

Syed Mahbubur Rahman, the former chairman of Association of Bankers Bangladesh (ABB) told, “Even though the transaction has started in rupees, its scope is still very limited. Bangladesh’s trade deficit with India is about 10 billion dollars. With such a large deficit, it is not possible to settle transactions in rupee. Again, the international acceptance of the rupee was not created in that sense. Transactions between the two countries would have been easier only when India accepted our money. But India will not take money against goods. That means at the end of the day we have to pay in dollars. That’s why Aku’s need will not decrease soon.’

However, this top executive of Mutual Trust Bank sees the start of transactions through rupees as positive. He said, “If ever our export income in India increases, we will be able to benefit from this system.” In that case, over-dependence on the dollar will decrease. China and Russia are also looking to position their currencies as alternatives to the dollar. Let’s see how far the two countries can go in the end.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…