Bangladesh fails to curb inflation

Mahfuja Mukul : Bangladesh Bank has taken contractionary monetary policy to reduce inflation but it is not working. High inflation can’t be reduced by monetary policy. On the other hand, due to contractionary monetary policy, interest rates are increasing every month. It increases the cost of business. Investments are affected and employment is adversely affected. Traders feel that the rise in interest rates is putting additional pressure on the economy.

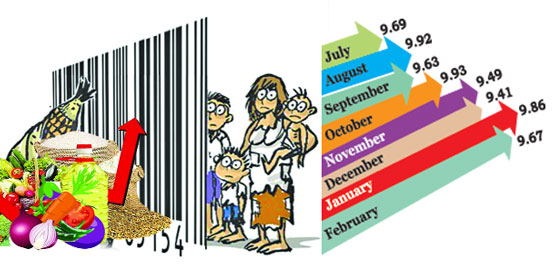

Point-to-point inflation has been over 9 percent every month from July to February of the current fiscal year. Last December, the government’s target was to bring it down to 8 percent. But it was not possible. The price of goods in the market has increased another round due to the current month of Ramadan. As a result, it can be assumed that inflation will increase in March. Experts say inflation cannot be reduced through monetary policy alone. It involves market management, supply chain and many other issues.

Those concerned said that inflation can be reduced by controlling the demand in the conventional rules of the economy. The central bank has also been reducing liquidity in the market by tightening monetary policy since last July. The government has been asked to borrow from commercial banks instead of providing central bank loans. Again, money came out of the market against the sale of dollars. This naturally increases the interest rate rapidly. As the interest on deposits increases along with loans, people are encouraged to reduce consumption and save. Again, interest in new investments with loans is less. It also reduces production. At the same time interest in borrowing for consumption has decreased. However, in many cases, this general rule of economy is not useful. Import dependency causes a ‘cost push’ i.e. dollar inflation. Apart from this, the traders in many cases increase the rates without any reason. The good news, however, is that the dollar hasn’t been appreciating for a long time. Imports have stabilized at Tk 122 to Tk124.

President of FBCCI, the top organization of businessmen Mahbubul Alam told that the interest rate is being increased every month through smart inflation control measures. Thus, the cost of doing business is increasing as the interest rate increases. He demanded that the interest rate should not be increased again by next June. He said some stability is returning to the dollar market. If the dollar falls, the market will normalize.

In a pre-budget discussion organized by Dhaka Chamber on Sunday, some business leaders said that the desired investment will not come if the interest rate increases. New employment will be hampered. The country will not run only on the formula of World Bank and IMF.

Although present at the same meeting, the deputy governor of the central bank Md. Habibur Rahman said there is no alternative to contractionary monetary policy to control inflation. However, interest rates have been raised less aggressively than in many countries so that business does not suffer. If the interest rates were not increased through smart measures, they would have increased at once and put a lot of pressure on the business. However, the Bangladesh Bank has previously said to take various measures including non-economic issues and market syndicate control to reduce inflation.

Association of bankers’ chief executive, Association of Bankers, Bangladesh (ABB) Chairman and Managing Director of BRAC Bank Salim RF Hossain said that it takes 6 to 9 months, sometimes a year, to see the effect of interest rate increase. But here we have not only interest rate effect behind inflation. Many times, due to syndicate of suppliers the price of product increases. He said, on the occasion of Ramadan, the price of goods has reduced to half in many countries. And our rates have doubled here. Now this rate increase can no longer be controlled by interest rate.

A senior official of Bangladesh Bank told that economic and non-economic issues must work together to control inflation. The central bank is keeping tight control over the economy by tightening monetary policy and keeping the dollar stable. In the meantime, the supply of liquidity in the market has decreased. At the same time, it is the government’s responsibility to look at non-economic issues such as ensuring fair supply, transport costs, utility charges, extortion. If these two are not coordinated, inflation will not be controlled.

Interest has to be calculated every month

From April 2020 to last June, the maximum interest rate on bank loans was fixed at 9 percent. However, the central bank introduced a new interest rate regime from last July to control inflation by reducing IMF loan conditions and liquidity supply in the market. This system is called SMART or Six Month Moving Average Rate of Treasury Bills. This interest is being determined on the basis of the six-month average interest rate of 182-day treasury bills. Banks determine the interest by adding a margin of 3.5 percent with Smart. Last February’s smart was 9.61 percent. This means that the highest interest rate on bank loans rose to 13.11 percent in March. Banks may levy an additional 1 percent supervisory charge on CMSME, personal and car loans. This means that the maximum interest rate in this case has risen to 14.11 percent. After the introduction of the new system, the highest interest rate on loans rose to 9.10 percent in July last year. After that, it has increased every month and reached this stage. As the interest rate increases every month, the existing loan also increases the interest every month, not so much. Rather, banks can increase interest rates every six months. In this case, the bank may have increased the interest rate of a customer last January. Now he will not be able to increase his interest before next July.

Reserves again below $20 billion

The central bank has taken various initiatives to restore stability in the dollar market. Opening of accounts in foreign currency and depositing money, various policies of offshore banking have been relaxed. Dollars have been brought from banks through currency swaps. As a result, foreign exchange reserves of $19 billion rose to over $21 billion last week. Reserves stood at $21.15 billion at the end of last week. However, after paying $1.29 billion to the Asian Clearing Union (ACU), it again fell below $20 billion. Reserves stood at $19.98 billion yesterday. However, the whining about the dollar has subsided somewhat. Basically, $428 million of remittances came through the banking channel in January-February. Compared to the same period last year, which is $76 million or 21.59 percent more. Again, in the first eight months till last February, exports were $3,845 million. Compared to the same period of the previous financial year, which is 3.71 percent higher. Again, imports have been reduced through various regulatory measures. LC settlement fell by 15.37 percent in the seven months to January of the current financial year. Imports decreased by 15.81 percent last fiscal year. Due to these reasons, the dollar market is stable even though the reserve is increasing and decreasing.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…