Bangladesh losing debt repayment capability

Decreasing reserves, increasing debt

Mahfuja Mukul: Bangladesh’s foreign debt has been increasing rapidly for several years. However, during this period, private debt increased at a slightly lower rate. However, the foreign debt of the public sector has increased at a much higher rate.

As a result, by the end of 2023, the country’s total foreign debt has exceed$100 billion for the first time. However, Bangladesh’s foreign exchange reserves have been declining for several years. In this, the ability to repay foreign debt is gradually decreasing.

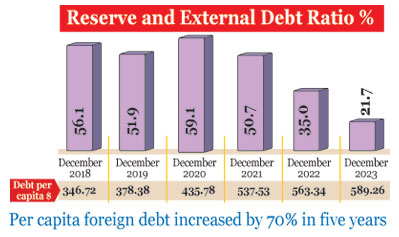

This information has emerged in a recently published report of Bangladesh Bank. It can be seen that the ratio of reserves to the total external debt has fallen below half. At the end of December 2018, the ratio of foreign debt to total reserves was 56.1 percent. By the end of 2023, it has dropped to 21.7 percent. That is, the ratio of foreign debt and reserves has decreased by about 34.5 percent in a span of five years.

According to the data of Bangladesh Bank, the foreign debt position of Bangladesh at the end of 2018 was $57.07 billion. At the end of December 2019, it increased to about $63 billion. In 2020, it increased to $73.02 billion, $91.01 billion in 2021 and $96.5 billion in 2022. By the end of 2023, foreign debt has increased to $100.64 billion. In other words, foreign debt has increased by $43.57 billion during this 5-year period.

At the end of 2018, the total (gross) reserves were $32.02 billion. At the end of 2019, it increased slightly to $32.69 billion. At the end of December 2020, the reserves increased slightly to $43.17 billion and at the end of December 2021 it stood at $46.15 billion. Reserves declined rapidly over the next two years. Among them, the gross reserve at the end of December 2022 was $33.75 billion and at the end of December 2023 (according to the Balance of Payments or BPM-6) it was $21.89 billion.

Based on this, the report shows the ratio of foreign debt and reserves of the last six years. It can be seen that at the end of 2018, the ratio of reserves and foreign debt was 56.1 percent. That is, more than 56 percent of the foreign debt could be paid with the existing reserves at that time. The following year it slightly decreased to 51.9 percent. In 2020, foreign debt increased rapidly, but reserves increased at a faster rate than that. At the end of December that year, the ratio of foreign debt and reserves stood at 59.1 percent. That is, 59 percent of the foreign debt could be paid with the existing reserves at that time.

This ratio has been decreasing for the next three years. In 2021, although the reserves increased slightly, the external debt increased several times more than that. At the end of December that year, the ratio of foreign debt and reserves decreased to 50.7 percent. In 2022, the reserve further reduced this ratio to 35 percent. And at the end of last year, reserves were at their lowest level in a decade. In this, the ratio of foreign debt and reserves has decreased to 21.7 percent. In other words, it was possible to pay only 21.7 percent of foreign debt with reserves last December.

According to the data of Bangladesh Bank, in the last five years, the foreign debt of the public sector has increased by $35.14 billion and the private sector has increased by $8.42 billion. At the end of 2018, the foreign debt position in the public sector was $44.55 billion, which stood at $79.69 billion at the end of 2023. And at the end of 2018, the foreign debt status of the private sector was $12.52 billion, which stood at $20.95 billion at the end of 2023.

Foreign debt has grown at the fastest rate in the last five years. Among them, $5.92 billion increased in 2019, $9.95 billion in 2020, a record $17.85 billion in 2021, $5.71 billion in 2022 and $ 4.13 billion in 2023. External debt has been increasing rapidly over the years, both in terms of volume as well as a proportion of gross domestic product (GDP).

According to the report, at the end of 2018, the ratio of foreign debt to GDP was 17.1 percent. In 2019, it increased slightly to 17.2 percent. In 2020, it increased slightly to 19.1 percent, by the end of 2021 to 20.8 percent, by the end of 2022 to 22.6 percent and by the end of 2023 to 23.6 percent.

Meanwhile, due to the increase in foreign debt, per capita debt has also started to increase rapidly. At the end of December 2018, foreign debt per capita was $346.72, which stood at $589.26 at the end of last December. In other words, foreign debt per capita has increased by almost 70 percent in a span of five years. Besides, per capita foreign debt at the end of 2019 stood at $378.38, at the end of 2020 it was $435.78, at the end of 2021 it was $537.53 and at the end of 2022 it was $563.34. That is, in 2021, per capita foreign debt increased the most ($101.75).

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…