BPC makes buffer bank deposit of Tk 32,000 cr

No sign of reducing price despite price declined in int’l market

Zarif Mahmud: The state run Bangladesh Petroleum Corporation (BPC) has not reduced the oil prices despite the fuel oil price in the international market have reduced significantly. Rather the organisation has made a laudable deposit in different banks, which is more than Tk 32,000 crore with interest till November 10 of the current calendar year.

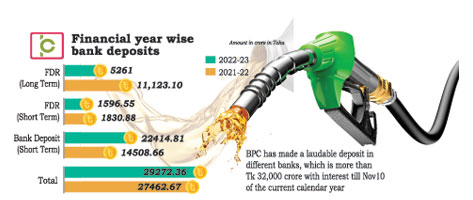

The state-owned Bangladesh Petroleum Corporation (BPC) fell into losses in the financial year 2021-22 after seven consecutive years of huge profits. However, the only company that imports and markets fuel oil has made a big profit in the last financial year. Still, without reducing the price of fuel oil, BPC deposited the surplus money in various banks of the country. Apart from this, there is also cash from oil sales in various banks. In all, BPC’s bank deposits have increased to Tk 29,272 crores.

This information has emerged in the latest audited financial report of BPC (FY2022-23) published recently. It shows that at the end of the financial year 2021-22, the amount of bank deposits of BPC was Tk 27,462.67 crore. Last financial year it increased to Tk 29,272.36 crore. That is, the company’s bank deposits have increased by Tk 1,809.69 crores in a span of one year. However, in FY2022-23, BPC’s long-term and short-term FDRs have decreased. However, the amount of short-term deposits has increased.

According to information, BPC’s FDR in four state-owned banks and one financial institution was Tk 5,261 crore till June 30 of the last financial year. Against these deposits, four banks are giving interest of five and a half to six percent. And the state-owned financial institution Investment Corporation of Bangladesh (ICB) is giving six to seven percent interest. At the end of the previous financial year, the long-term FDR of BPC was Tk 11,123.13 crore. In other words, in one year, BPC broke the long-term FDR of Tk 5,862.13 crore.

At the end of the financial year 2022-23, long-term FDR in Janata Bank of BPC was Tk 1,621.04 crore, Rupali Bank Tk 1,522.86 crore, Sonali Bank Tk 1,8739 crore, Agrani Bank Tk 759 crore and ICB Tk 270.61 crore. BPC has slightly increased long-term FDR in Sonali Bank last financial year. FDR was picked up from the rest by the oil marketing company.

Meanwhile, at the end of the fiscal year 2022-23, the deposit of BPC as short-term FDR in eight private banks of the country was Tk 1,596.55 crore. At the end of June 30 of the financial year 2021-22, its amount was Tk 1,830.88 crore. That is, in one year, BPC short-term FDR broke Tk 234.33 crore.

At the end of June 30, AB Bank had Tk 588.50 crore, First Security Islami Bank Tk 477.63 crore, ICB Islamic Bank Tk 121.49 crore, Mercantile Bank Tk 112.34 crore, Global Islami Bank Tk 164.44 crore, Union Bank Tk 110.56 crore, BPC had a short-term FDR of Tk 10.80 crore in Social Islami Bank and Tk 10.80 crorein United Commercial Bank (UCB). Against these FDRs, the banks are giving interest at the rate of six percent.

On the other hand, BPC’s short-term deposits (SND/STD) and cash deposits (current account) in public-private and foreign 32 banks at the end of June last financial year were Tk 22,414,810,000. At the end of the financial year 2021-22, its amount was Tk 14,508.63 crore. That is, the short-term deposits of BPC increased by Tk 7,906.15 crores in one year. Short term deposit or cash deposit banks include Desi Sonali, Janata, Agrani, Rupali, AB, BRAC, Eastern, Exim, First Security Islami, IFIC, Islami, Jamuna, Meghna, Mercantile, Madhumati, Mutual Trust, National, NRB, NRBC, Apart from One, Padma, Premier, Prime, South Bengal, Southeast, The City, UCB and Union, there are foreign Standard Chartered, Citibank NA, HSBC and State Bank of India.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…