Bank & Finance

Bank & Finance

Why good banks will take liability of bad banks?

Special Correspondent : For the purpose of reforming the banking sector, Bangladesh Bank is suggesting to merge all the weak or bad banks with strong or good banks.There are currently 61 banks in Bangladesh. Observers say that about 40 of these banks are doing well, but the condition of the…

Read More »Govt borrowing from ITFC by depositing BB reserves

Special Correspondent : The Department of Energy and Mineral Resources has signed a loan agreement of $2.1 billion with the International Islamic Trade Finance Corporation (ITFC), a subsidiary of the Islamic Development Bank (IDB). Bangladesh will be able to import fuel oil and liquefied natural gas (LNG) under this agreement.…

Read More »7-banks and 2 money changers involved in money laundering

Staff CorrespondentBankers buy foreign currency including dollars from travelers coming from abroad and sell them outside without showing it to the banking channel. Anti-Corruption Commission (ACC) Secretary Md. Mahbub Hossainsaid that the officials of seven banks and two money exchangers are involved in this money laundering.He said these things to…

Read More »About Tk 19,000 crore rescheduled in 9-month

Staff Correspondent: Commercial banks are leaning towards rescheduling after relaxation in rescheduling policy. Banks can now reschedule any defaulted loans themselves if they want. Due to this exemption, the amount of rescheduled loans is increasing abnormally. Through this, the bank can show less defaulted loans.In the first nine months of…

Read More »Govt’s debt increased by 92 pc in 4 years

Nasiruddin Ahmed : The government regularly borrows to meet the budget deficit. For shortfall in revenue, the government borrows from various sources to meet its day-to-day expenditure. Besides, the government is taking loans every year from different sources, both domestic and foreign, for the implementation of development projects. This increases…

Read More »China reluctant in fresh loan

Interested for trade in Chinese currency Rabiul Haque : Chinese loan discount for Bangladesh reduced. Again, the country has not given any new promise of financing any project in recent times. China’s debt relief has been brisking in the past two fiscal years. At this time, big projects were also…

Read More »Over 40 banks facing acute liquidity crisis

Mahfuja Mukul : The liquidity crisis in the banking sector is increasing day by day. This is also leading to volatility in the interbank currency market, which has further fueled the liquidity crunch. Banks are struggling to meet the increased demand for cash. Most of the banks are forced to…

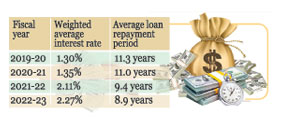

Read More »Foreign loan interest rate increasing

China-Russia set tough terms Zarif Mahmud : The foreign debt of the government has been increasing rapidly for several years. Among these are China, Russia’s tough terms and high interest loans. Due to these loans, the average interest rate of the government’s foreign debt repayment is increasing. Interest rates on…

Read More »Capability of sustaining loan risk decreasing

Effect of increase in defaulted loans to bank In 2020, defaulted loans in the banking sector were Tk 88,730 crores. It increased to Tk 1 lakh 56 thousand crores in June. In two and a half years, defaulted loans have increased by Tk 67,270 crore or 76 pc Zarif Mahmud…

Read More »India-China-Russia deliver only 20.5pc of foreign loan

Mahfuja Mukul : Recently, India, China and Russia are playing a major role in Bangladesh’s political arena and global relations. Apart from the 12th National Assembly elections, the countries were busy at various times. Although the three countries are far behind in the support of various development projects of Bangladesh.…

Read More »