India-China-Russia deliver only 20.5pc of foreign loan

Mahfuja Mukul : Recently, India, China and Russia are playing a major role in Bangladesh’s political arena and global relations. Apart from the 12th National Assembly elections, the countries were busy at various times. Although the three countries are far behind in the support of various development projects of Bangladesh. Since independence, only 20.5 percent of the loans taken for Bangladesh’s various development projects have come from India, China and Russia. World Bank, Asian Development Bank (ADB) and Japan are in the top three positions.

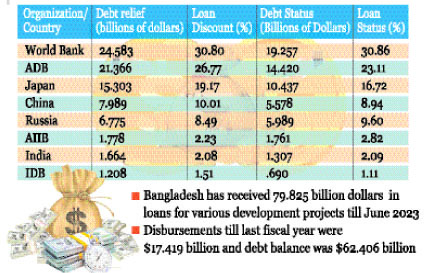

This information has emerged in the latest report of the Economic Relations Department (ERD). It can be seen that, from 1971-72 to 2022-23 fiscal year, Bangladesh received $79.825 billion in loans for development projects in 52 years. Of this, $17.419 billion have been paid till last financial year. And at the end of last June, the foreign debt of the government stood at $62.406 billion. Of this, the World Bank’s single loan is about 31 percent.

The World Bank, which is at the top in terms of foreign loan concessions, gave Bangladesh $24.583 billion till last June, which is 30.80 percent of the total loans. Second ranked ADB has lent the government $21.366 billion as of last June, which is 26.77 percent of total loans. Japan, which is in the third position, has so far loaned Bangladesh $15.303 billion, which is 19.17 percent of the total loan.

They were supposed to give loans for the construction of Padma Bridge. However, these three development partners were removed due to allegations of corruption conspiracy. However, the World Bank, ADB and Japan are still providing regular loans for various development projects.

China is in the fourth position in terms of debt relief. The country has so far loaned Bangladesh $7.989 billion for various development projects, which is 10.01 percent of the total loans. Next in line is Russia, which has written off $6.775 billion as of last June, which is 8.49 percent of the government’s debt. Countries and companies in the next top five have relatively low debt levels.

The Asian Infrastructure Bank (AIIB), ranked sixth in lending, has discounted $1.778 billion, which is 2.23 percent of the government’s total discounted loans, till last June. Neighboring India ranks seventh in lending. As of last June, the country has written off $1.664 billion, which is 2.08 percent of the government’s total written off debt. And the eighth-ranked Islamic Development Bank (IDB) disbursed $1.208 billion as of last June, which is 1.51 percent of the government’s total disbursed loans. The debt of the rest of the countries is less than $1 billion.

Meanwhile, the World Bank is at the top in terms of foreign debt status. As of last June, the debt status of this organization was $19.257 billion, which is 30.86 percent of the total debt. ADB, in second place, had a debt standing of $14.420 billion as of last June, which is 23.11 percent of total debt. And the debt status of Japan, which is in the third position, stands at $10.437 billion, which is 16.72 percent of the total debt.

Most of the loans from the top three sources have easy terms. Among these, the Japanese government gives loans to Bangladesh with the lowest interest and easy terms. Next in line are the World Bank and ADB, almost all of whose loans are on soft terms. However, Japan raised interest rates slightly to become a middle-income country. World Bank and ADB loan interest rates have also increased slightly. Besides, the two organizations have proposed loans to Bangladesh with some difficult conditions. ERD has projected that Bangladesh’s foreign debt interest rate will increase slightly after its transition from LDC status.

As of last June, the fourth-ranked China’s debt position was $5.578 billion, which is 8.94 percent of the total debt. Russia, which is in the next position, had a debt of $5.989 billion as of last June, which is 9.60 percent of the government’s debt. The loan conditions of these two countries are difficult and interest rates are very high. Bangladesh is under pressure to repay these loans with difficult conditions.

Meanwhile, AIIB is increasing lending to Bangladesh as a new development aid agency. At the end of last June, the debt position of the organization stood at $1.761 billion, which is 2.82 percent of the total foreign debt. India, ranked seventh, had a debt position of $1.307 billion as of last June, which is 2.09 percent of the government’s total debt. And the debt position of the eighth-ranked IDB stood at $690 million as of last June, which is 1.11 percent of the government’s total debt. Among the three, AIIB and India lend on easy terms, but IDB’s loans have higher interest rates and shorter repayment periods.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…