Foreign debt to be doubled in 2 years

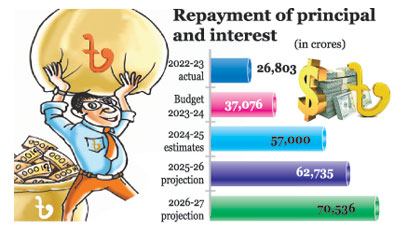

Mahfuja Mukul : In the financial year 2022-23, the government has spent Tk 26,803 crores in the payment of principal and interest on foreign loans. The estimate of the economic relations department of the government is that in the next financial year (2024-25) the expenditure will be Tk 57 thousand crore. Of this, the principal is Tk 36,500 crores and the interest is Tk 20,500 crores. This means that the government’s expenditure on foreign debt repayment will more than double after two years. The government has to prepare the budget for the next financial year keeping in mind the increasing payment pressure.

The Economic Relations Department-ERD is responsible for the payment of foreign loans and interest on behalf of the government. ERD recently wrote to the finance ministry to increase the fixed expenditure limit by Tk 16,000 crore as the payment pressure is increasing. ERD Secretary Shahriar Quader Chiddiquisigned the letter by informing that there is an obligation to pay loan installments and interest as part of the external debt management program. The government has implemented several mega projects through foreign loans. For the implementation of these projects, foreign loans have been taken at a higher rate. As a result, the amount of paid loans is gradually increasing. Moreover, the repayment of the new loan has already started.

According to ERD’s letter, about 45 percent of the current foreign loans are in SDR (Special Drawing Rights, which is the currency of the IMF). Loans are to be repaid in US Dollars and British Pounds. Foreign debt is increasing due to the exchange rate of dollar and pound with SDR and exchange rate of rupee with dollar and increase in benchmark rate of dollar and euro. At the same time, certain amount of money has to be paid in foreign currency for various international contributions or share capital. Therefore, in the budget of the next financial year 2024-25, the expenditure limit set in favor of ERD is demanded to be increased in the letter.

The minutes of the Budget Management Committee meeting held recently under the chairmanship of Shahriar Quader Siddiqui are attached to the letter. It is mentioned that in the budget of the current financial year 2023-24, a total allocation of Tk 37,831 crores is kept for the favorable development, management and special activities of ERD. And for the next financial year, the Ministry of Finance set the limit for the ERD in the next budget formulation of Tk 41,607 crores for the government’s estimate for foreign loan installments and interest payments and other expenses.

But after reviewing the current trend of loan installments and interest payments and the future demand, ERD says that it is not possible to formulate a budget within this expenditure limit. Because the foreign debt-related liabilities are increasing gradually. It will increase in the coming years.

According to the ERD data, the government spent Tk 4,224 crore in the last financial year 2021-22 on interest payments on foreign loans. The next financial year it more than doubled to Tk 9,368 crores. In the current financial year 2023-24, Tk 12,376 crores have been allocated for this sector. For the next fiscal year 2024-25, the cost of interest payment has been estimated at Tk 20,500 crores. In the next two financial years, the expenditure projection in this field is Tk 21,375 crores and Tk 24,576 crores respectively.

Meanwhile, Tk 13,166 crore were spent in the last fiscal year 2021-22 for repayment of loan installments. In the next financial year, it increased to Tk 17,435 crores. In the budget of the current financial year 2023-24, Tk 24,700 crores have been allocated for this sector. For the next fiscal year 2024-25, the expenditure for installment payments is estimated at Tk 36,500 crores. For the next two financial years, the expenditure projection in this field is Tk 41,359 crores and Tk 45,960 crores respectively.

The government is implementing several big projects with foreign funding. These include Rooppur Nuclear Power Plant, Padma Bridge Rail Link Project, Metrorail (Line-6), Third Terminal of Hazrat Shahjalal International Airport, Karnaphuli Tunnel, Matarbari Coal Power Plant, Chittagong-Cox’s Bazar Railway etc.

According to the data of Bangladesh Bank, at the end of last September, foreign loans taken by the public and private sectors stood at $9,655 million, which was $4,117 million in the fiscal year 2015-16. Foreign debt has more than doubled in eight years. The bulk of external debt (77 percent) is to the public sector. Debt arrears are adding to the pressure on foreign exchange reserves, which are in crisis.

Former Finance Department Secretary Mahbub Ahmed told that the budget has been decided to be contractionary due to various reasons. But despite more than a decade of discussions and various initiatives to increase internal revenue collection, it has not been possible to implement it. As a result, the foreign debt burden on the government increased, which created a financial crisis. Still, Bangladesh has not defaulted on its foreign debt so far. But in the future, the government will have to decide whether to increase the debt crisis or give importance to increasing revenue.

Economists say that Bangladesh’s foreign debt as a proportion of gross domestic product (GDP) is still at a tolerable level. This rate is about 22 percent. However, if export income, expatriate income and foreign investment, i.e. increasing the supply of foreign currency, as well as increasing the overall revenue, the repayment of foreign debt can create a major crisis in the economy.

According to the International Monetary Fund’s (IMF) latest Debt Sustainability Analysis, Bangladesh’s external debt is low risk by international standards. In this context, the executive director of the private research organization Policy Research Institute (PRI). Ahsan H Mansoor told that the debt situation needs to be analyzed in terms of revenue and not GDP. Because money or dollars are needed to pay the debt. He said that Bangladesh’s revenue rate as a proportion of GDP is very low. Bangladesh’s debt to revenue ratio is 380 percent. Overall debt repayment has emerged as one of the crises in the country’s economy.

A senior official of the finance department told, assuming that the economic slowdown is not ending soon, the budget is being revised by cutting the government’s expenditure by around Tk 60 thousand crore in the current fiscal year 2023-24. At the same time, it has been decided to formulate a contractionary budget in the next financial year 2024-25 in coordination with the monetary policy, giving priority to inflation control. In light of this, various ministries and departments have been instructed to formulate budgets within the prescribed expenditure limits. But the ERD has proposed to increase the spending limit in view of rising foreign debt repayments. A final decision will be taken after reviewing the matter.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…