People lost interest in insurance

Policy issued

Mahfuja Mukul: Although the government has taken various steps to attract people towards insurance, it seems that it is not working very well. Rather, the country’s insurance is going in the opposite direction day by day. The number of insurance customers is continuously decreasing. Industry stakeholders believe that this situation is arising due to widespread irregularities in some life insurance companies and non-payment of claims on time.

They say, not all insurance companies are bad. Few companies are doing business with reputation. They are regularly paying the claims of the customers. But the information of irregularities of several companies has come out. Which has a negative impact on the overall insurance sector.

The insurance sector already has an image crisis. In the meantime, some companies are struggling to pay the insurance claims of customers. As a result, the number of insurance customers in these companies is decreasing. However, the number of customers is increasing in those companies which are paying the customer’s claims in a correct manner and on time.

On the other hand, the decline in customers in the insurance sector is worrying the officials of the regulatory agency Insurance Development and Regulatory Authority (IDRA). Because of this, various steps are being taken to ensure that the insurance companies properly pay the claims of the customers, the officials of the regulatory body claim.

Once campaigning within the country, insurance means fraud. And the insurance department was full of corruption. As a result, educated manpower has come less in the insurance sector, on the other hand customer confidence has not been created.

However, the current government abolished the Directorate of Insurance and formed a new regulatory agency, IDRA, in 2011. Along with that, the new Insurance Act 2010 was enacted. The activities of IDAA started by appointing M. Shefak Ahmed, who has the highest degree in insurance profession, as the chairman and banker, university teacher and former registrar of the high court as members.

Their strict action against corruption and irregularities has spread panic in the insurance sector. Insurance companies have broken the shell of irregularities and come within the rules. But later that role of the regulatory body was no longer seen. M Mosharraf Hossain was even forced to resign from the post of chairman of IDRA recently due to allegations of various irregularities.

In addition to various irregularities by the head of the regulatory body, various companies continue to neglect payment of insurance claims and harass policy customers in various ways. As a result, the general public’s confidence in insurance has decreased. Due to which large part of the country is out of insurance coverage.

A review of the data shows that the number of active insurance policies in the life insurance companies doing business in the country in 2017 was Tk 2 crore 8 lakh 60 thousand. At that time the number of life insurance companies was 31.

At present 35 companies are doing life insurance business in the country under public-private and domestic-foreign ownership. Among them, there is one company under domestic-foreign joint ownership and one company is wholly foreign owned. And there is a government-owned company. As of March this year, the number of active insurance policies in these companies is 73 lakh 83 thousand.

In other words, the number of policies of life insurance companies has reduced to less than half in a span of five years. But during this period, on the one hand, the number of life insurance companies doing business in the country has increased, on the other hand, the country’s economy has grown.

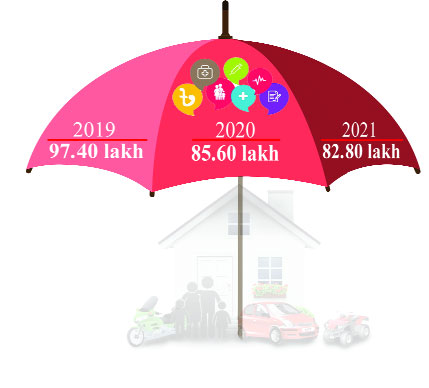

The number of customers in life insurance companies did not decrease overnight. has decreased consistently over the years. In 2019, the active policies of the life insurance companies doing business in the country were 97 lakh 40 thousand. The next year in 2020, it decreased to 85 lakh 60 thousand. In 2021, it further decreased to 82 lakh 80 thousand.

National Life is on top in terms of number of customers (selling insurance policies). According to the information given by the company to IDRA, the number of policies sold by the company is 17 lakh 8 thousand 996. The number of policies of Delta Life in the second place is 12 lakh 50 thousand 952. Metlife, a foreign-owned company, is in third place by selling 10 lakh 95 thousand 192 policies.

Besides, 7 lakh 53 thousand 621 of Popular Life, 3 lakh 66 thousand 609 of JibonBima Corporation, 3 lakh 10 thousand 719 of Fareast Life, 2 lakh 94 thousand 550 of Meghna Life, 2 lakh 73 thousand 83 of Pragati Life, 2 lakh 42 thousand 486 of Sunlife, Sonali Life has 2 lakh 6 thousand 623, Prime Islami Life 1 lakh 90 thousand 787, Sandhani Life 1 lakh 47 thousand 55 and Rupali Life has 1 lakh 24 thousand 615 policies.

The number of policies of the rest of the companies is less than one lakh. Among them, 90 thousand 547 of Homeland Life, 51 thousand 748 of Sunflower Life, 50 thousand 341 of Alfa Islami Life, 39 thousand 145 of Guardian Life, 23 thousand 149 of Chartered Life, 20 lakh 20 thousand 294 of Mercantile Islami Life, 19 thousand 894 of Progressive Life, Golden Life 18 thousand 359, Bengal Life 17 thousand 272, Padma Islami Life 14 thousand 972, Trust Islami Life 13 thousand 410 and Zenith Islami Life have 10 thousand 168 policies.

Among the companies having less than 10 thousand insurance policies alone, Best Life has 9 thousand 251, Swadesh Life 7 thousand 972, NRB Islamic Life 7 thousand 460, Life Insurance Corporation (LIC) of Bangladesh 7 thousand 182, Diamond Life 4 thousand 376, Akiz Takaful Life 3 971 thousand, Protective Islami Life 3 thousand 755, Astha Life 3 thousand 87 and Jamuna Life 1 thousand 81 policies.

A chief executive officer (CEO) of a life insurance company said on condition of anonymity that IDRA took strict action against irregularities early on. As a result, almost all insurance companies come within the rules. But later the top officials of the regulatory body were involved in various irregularities. Taking advantage of this, some insurance companies have committed major irregularities. This has weakened the financial condition of the company. Again, the insurance claims of the customers could not be paid. As a result, people’s confidence in insurance has not increased. Rather decreased.

CEO of Pragati Life Jalalul Azim told, I don’t know the status of other companies. But the business of our company has not decreased. Our number of businesses is growing. If the policy is less in the industry (insurance sector), then it is definitely not a good sign. Because the population of our country is increasing, the economy is getting better and better. Per capita income and education rate of people are increasing. The number of insurance companies has increased. In that case, we should increase our policy.

Some companies are defaulting on payment of customer claims. Does it affect insurance policy reduction? In response to such questions, he said that many companies’ policies have expired, they could not pay the claim. As a result, they have a bad reputation in the market. As a result, those companies are not able to make new policies very much. The number of these companies is not very small. This can be a reason for reducing the insurance policy. Non-payment of customer claims is a major problem in the insurance sector.

He said, due to non-payment of claims, our image crisis has arisen. Due to which the regulatory body is also now emphasizing on payment of claims. Even in insurance fairs, they have asked all the companies to pay the claims very strongly. Regulatory agencies are trying. But the problem is that some companies will pay the claim, they don’t have that money. They don’t even have enough resources. As a result, it is not possible for them to pay the claim even if pressed.

IDRA Chairman Zainul Bari said that the years 2019 and 2020 have been bad due to Corona pandemic. We are now taking up many types of programs, campaigns. I have done insurance fairs and seminars. We are meeting with the insurance companies so that the claims of the customers are paid properly. We give utmost importance to the customers to get the money they claim. Calling one company at a time, we give a dateline for payment of the claim. Besides, we are taking various steps including bringing new products.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…