Tk 1.5 lakh cr to be spent on interest payment in 3-yr

Zarif Mahmud: The size of the government budget is increasing every year. The budget deficit is increasing along with it. To meet the shortfall, the government is regularly taking loans from domestic sources such as banks and savings bonds. The amount of foreign loans is also increasing for the implementation of various development projects. But as the amount of debt is increasing rapidly, its interest payment has now become a burden for the government.

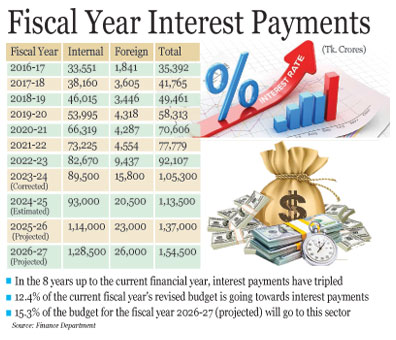

12.4 percent of the current fiscal year budget is going to pay interest. However, after three years in the fiscal year 2026-27, this cost will increase a lot. 15.3 percent of the budget should be spent on interest payments in that financial year. This information came out in the publication titled ‘Medium Term Macroeconomic Policy Statement: 2024-25 to 2026-27’ published by the Finance Department. It was released on June 6 as a companion publication to the proposed budget for the fiscal year 2024-25.

It can be seen that the government’s interest payment expenses will exceed Tk 1.5 lakh lakh crore in the financial year 2026-27. Out of this, Tk 128,500 crores will go to pay the interest of internal debt. And Tk 26 thousand crore will be spent on foreign debt interest payment. That is, it is projected that the total cost of paying interest in that fiscal year will be Tk 1 lakh 54 thousand 500 crores.

However, if the government is not restrained in borrowing and the foreign currency exchange rate increases, the amount of interest payments will be higher than this, experts believe.

Regarding interest payments, the Medium-Term Macroeconomic Policy Statement says, “The government’s projected interest expenditure over the medium term indicates an upward trend in government spending in this sector.” According to the interest payment estimate, the interest expenditure in the financial year 2021-22 may increase from Tk 777.7 billion to Tk 1,545 billion in the financial year 2026-27. That is, the interest payment cost will almost double in six years.

The report further states, ‘Most of the total interest expenditure is spent on domestic interest payments, which is estimated to increase to Tk 1,285 billion in FY 2026-27 from Tk 732.18 billion in FY 2021-22. The share of domestic interest payments will decrease from 14.1 percent of the budget in 2021-22 to 11.7 percent in 2024-25. However, it may rise again to 12.7 percent in the financial year 2026-27.

Regarding foreign loan interest, the finance department says, ‘Although the share of foreign interest in the total interest expenditure is very low, the amount of foreign interest may increase from Tk 45.6 billion in the fiscal year 2021-22 to Tk 260 billion in the fiscal year 2026-27. The ratio of foreign interest in the total budget is also estimated to increase from 0.9 percent in FY 2021-22 to 2.6 percent in FY 2026-27. The increasing impact of foreign debt interest on the budget is noticeable.

Analyzing the budget data of the last few years, it can be seen that the government’s interest payment expenditure for the fiscal year 2016-17 was Tk 35,392 crores. Out of this, the interest paid on domestic debt was Tk 33,551 crores and the interest on foreign debt was Tk 1,841 crores. In the next financial year, the interest payment expenses increased to Tk 41,465 crores. Out of this, the interest payment cost of domestic debt stood at Tk 38,160 crores and the cost of foreign debt interest payment was Tk 3,605 crores. In other words, the foreign loan interest payment almost doubles in one year.

In the financial year 2018-19, the interest payment cost increased to Tk 49,461 crores. Out of this, interest on domestic debt was Tk 46,015 crores and interest on foreign debt was Tk 3,446 crores. In that fiscal year, the interest payment on foreign debt decreased slightly compared to the previous fiscal year. Apart from this, the interest payment cost of foreign debt also decreased slightly in FY 2020-21.

In the financial year 2019-20, the interest payment cost has increased yet another time and stands at Tk 58,313 crores. Out of this, interest on domestic debt was Tk 53,995 crore and interest on foreign debt was Tk 4,318 crore. However, interest payments increase significantly in the following financial year. Tk 70,606 crores of interest was paid in that financial year. Out of this, interest on domestic debt was Tk 66,319 crores and interest on foreign debt was Tk 4,287 crores. Interest payments grew by a record 21 percent in FY2021-21.

Although the expenditure in this sector increases relatively less in the fiscal year 2021-22. Tk 77,779 crores of interest was paid in that financial year. Out of this, interest on domestic debt was Tk 73,225 crore and interest on foreign loan was Tk 4,554 crore. In the fiscal year 2022-23, the interest payment expense again jumped by about 18.5 percent.

In that financial year, interest payment expenses increased to Tk 92,107 crores. Out of this, interest on domestic debt was Tk 82,670 crores and interest on foreign debt was Tk 9,437 crores. Interest payments on external debt increased by over 107 percent last fiscal year, putting pressure on total interest payments. However, the domestic interest expenditure trend has been rising at the same rate for several years.

Meanwhile, the interest payment expenditure in the current financial year has also exceeded the target. This target in the budget was Tk 98,300 crores. However, in the revised budget, the amount of interest payment has been increased by Tk 105,300 crores. Out of this, Tk 89,500 crores will go to pay the interest of domestic debt and Tk 15,800 crores will have to pay the interest of foreign debt. As such, interest payment expenses have increased three times in 8 years up to the current financial year.

On the other hand, in the proposed budget for the next financial year, the amount of interest payment has been estimated at Tk 1 lakh 13 thousand 500 crores. Out of this, the target of domestic interest payment has been set at Tk 93 thousand crores and Tk 20,500 crores will go to pay foreign debt interest. That is, the interest payment of foreign debt is increasing by about Tk 4,700 crore or about 30 percent in a year.

Finance Minister Abul Hassan Mahmud Ali said in the budget speech regarding foreign loan interest, Secured Overnight Financing Rate (SOFAR) is being used as one of the reference rates of interest rates in the world. In January 2022, this rate was 0.5 percent. SOFOR also increased due to interest rate hikes in various countries including the United States to control inflation caused by the Ukraine-Russia war. Last month it reached five and a half percent. Interest rates are increasing for the same reason in other developed countries including Europe. Reference rates like Euribor, Tona are also increasing because of this.

He also said that due to the increase in interest rates in the world, Bangladesh has to face two types of pressure. In the developed world, increasing interest rates have led to an increase in capital outflows (investments leaving) and a decrease in inflows (foreign investment inflows). As a result, the fiscal deficit is increasing on the one hand, and the foreign debt repayment liability is increasing on the other hand. In the fiscal year 2022-23, more than one billion dollars has to be spent on foreign debt interest payments. Interest rates are expected to decrease in the future in developed countries including the United States. If this is not correct, this trend will continue in the future.

The finance department has also projected the future interest expenditure in the medium-term macroeconomic policy statement. It can be seen that in the financial year 2025-26, interest payment may cost Tk 1 lakh 37 thousand crores. Out of this, Tk 1 lakh 14 thousand crores will go to pay interest on domestic debt and Tk 23 thousand crores will have to be paid on foreign debt. That is, the interest payment of foreign loans will increase by about 11 percent in that financial year. However, the interest payment cost of domestic debt will increase by about 22.5 percent.

And Tk 1 lakh 54 thousand 500 crore may be spent on interest payment in 2026-27 financial year. That is, interest payment expenses will increase by about 13 percent in that financial year. In the financial year 2026-27, the cost of paying interest on domestic debt is estimated at Tk 1 lakh 28 thousand 500 crore and the interest on foreign debt is Tk 26 thousand crore.

When asked about what kind of pressure the increase in interest costs is causing on the budget, Honorable Fellow of Center for Policy Dialogue (CPD), a private research institute and civic organization Dr.Debapriya Bhattacharya told that interest payments are now taking up about one-fourth of the operating budget. Besides, a lot of money is being spent on subsidies. But there is lack of transparency in subsidy expenditure. If a large part of the budget goes to interest and subsidies, it will be difficult to increase the supply of finance to sectors like education, health and development. In such a situation it is necessary to pay attention to interest management.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…