Tk 3,621 crore cash wentoutside bank in a month

Depositors fearing risk in bank

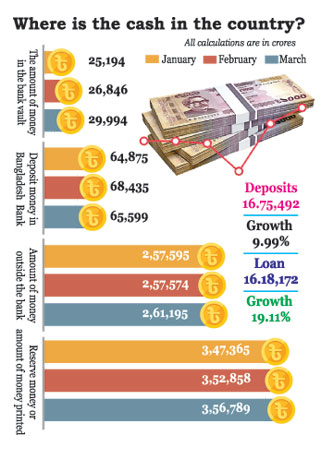

Zarif Mahmud: The amount of cash held by people outside the banks has also increased significantly. At the end of March, the amount of cash held by people outside the banking system has increased to Tk 2 lakh 61 thousand 195 crores. In February the amount was Tk 2 lakh 57 thousand 574 crores. As compared to February, the amount of cash in the hands of people has increased by Tk 3,621 crore.

This money was not returned to the bank that month. As a result, this money remains in the hands of people. It is believed that many people have withdrawn money from the banks due to the various initiatives. Meanwhile, the government is planning to increase the excise duty on the money deposited in the bank in the next financial year 2024-25.

The cost of keeping money in the bank is going to increase next year. As a result, the tendency to deposit money in the bank may decrease. It has been found that most of the people are withdrawing money to meet their daily needs. Many individuals are now buying treasury bills and bonds by withdrawing deposits or saving money. Some are investing in risky sectors including various associations, NGOs, land, flats outside the bank in the hope of more profit. Some people take the money and keet it at home. However, the bankers believe that the money will be deposited in the bank after a few days.

According to the data of Bangladesh Bank, the amount of money printed in the bank sector (reserve money) was Tk 3 lakh 47 thousand 365 crores last January. However, the currency supply increased by Tk 3 lakh 52 thousand 858 crore in February. Last March currency supply increased by Tk 3 lakh 56 thousand 789 crores. Along with the increase in money supply, (See Page-11)

(From Page-12)

cash in people’s hands is also increasing.

That is, people are withdrawing money from the bank and keeping it with themselves. In January, the amount of money outside the bank was Tk 2 lakh 57 thousand 295 crores. Which increased slightly to Tk 2 lakh 57 thousand 574 crores in February. In March, the amount of cash increased to Tk 2 lakh 61 thousand 195 crores. As a result, only in the month of March, the amount of money in people’s hands increased by Tk 3,621 crores.

People associated with the banking sector say that the amount of cash held by people has increased in March due to several reasons. One of them was the month of fasting. At this time, people’s demand for cash money increases. Apart from this, it was decided to merge several banks in March. Bangladesh Bank informed the concerned banks about these decisions.

Various rumors are associated with it. The depositors withdrew their deposits from some banks on this news. As a result, the amount of cash in people’s hands increases. People related to the banking sector say that after people withdraw money from the bank, what is not returned to the bank is known as out-of-bank money.

This money is either used by people to meet their daily needs, or they invest it in risky sectors including various associations, land, flats outside the bank in the hope of more profit. Some people take the money and keep it at home.

It is known that although the Central Bank has taken various initiatives to reduce the money supply to curb inflation, its effectiveness has been seen to be very low. Rather than decreasing the supply of currency, the reverse supply in the market has increased.

Apart from this, the supply of money in the market has been further increased by the government’s bond facilities given to various banks for fertilizer and electricity dues. The government has issued bonds against various banks for not being able to pay the dues with money. Banks are borrowing money from Bangladesh Bank by depositing these bonds. It increases the money supply.

Bank officials say that due to various measures taken by the central bank, the supply of currency in the market was decreasing slightly. But the Central Bank has given around Tk 21 thousand crores to the banks in the last few months against the bonds issued for payment of electricity and fertilizer subsidy arrears. Almost all of it is deposited in the central bank and the banks have taken the same amount of money for a period of 180 days. After the maturity of the loan, the banks can borrow money again for 180 days till the maturity of the bond.

Bonds issued by the government have a tenure of 8-10 years. Generally, when money supply increases in the market, inflation also increases. If you want to know about this, Bangladesh Development Research Institute-BIDS researcher and chairman of Agrani Bank Dr. Zayed Bakht said, “Although the money is outside the bank, the growth rate of deposits has increased. So, it should not be assumed that people are withdrawing money from the bank and that money is not coming back to the bank.

However, after the announcement regarding the bank merger, the depositors have withdrawn large amounts of deposits from some banks, but the reality is that the money has been deposited in other banks. A private bank MD said on condition of anonymity that cash transactions had increased in December last before the elections. Also, many people are losing their savings due to high inflation.

Again, many people are withdrawing money from the banks that are in crisis. Due to this, the amount of money in people’s hands has increased. However, he thinks that these money will return to the bank after a few days.

The cost of keeping money in the bank may increase. The cost of keeping money in the bank is going to increase next year. After 2022, the government is planning to increase the excise duty or excise duty on the money deposited in the bank again in the next financial year 2024-25. This amount is deducted from the bank balance of any person or organization in a year at a fixed rate, known as excise duty.

Even if a person goes to take a loan but the loan amount is deposited in his account, he also has to pay this duty. At present, no excise duty has to be paid on deposits of Tk 1 lakh by any person or institution at any time within a year. Sources related to the budget said that Tk 150 has to be paid on the status of Tk 1 lakh to Tk 5 lakh, which may be Tk 200 in the next budget.

The existing duty on status between Tk 5 lakh to Tk 10 lakh may increase from Tk 500 to Tk 600. At present Tk 3,000 is payable on balances between Tk 10 lakh and Tk 1 crore. This range can be divided into two parts. In the first phase, keeping the range from Tk 10 lakh to Tk 50 lakh unchanged, the range from Tk 50 lakh to Tk 1 crore may be increased from Tk 3,000 to Tk 5,000.

That is, within this range, if someone has money in the bank in one year, his duty is going to increase by about 67 percent. Syed Mahbubur Rahman, managing director of Mutual Trust Bank and former president of Association of Bankers Bangladesh, said that there is already a liquidity crisis in some banks. Increasing excise duty or excise duty at this time will increase the tendency of people to withdraw money.

Despite the increase in interest, the rate of bank deposits is slow. The cap, which fixed the interest rate on bank loans at 9 percent, was lifted in July last year. After that, Bangladesh Bank determines the ‘smart’ interest rate based on the average interest rate of treasury bills every six months. However, to reduce inflation and deal with the economic crisis, Bangladesh Bank made the interest rate market-based this month.

Now the interest rate of loans in banks is around 14 percent. At the same time, banks have started increasing the interest rates on deposits. There are various accounts for depositing money in banks. People who do business and need daily transactions, open current account. As such interest is always low. Then there is less interest as savings.

And banks give higher interest on various term, fixed deposits and schemes. Currently, some banks are accepting deposits at around 12-13 percent. In this situation, several banks have started a sick competition to collect deposits. Dozens of banks are accepting deposits on the condition that they double their money in five years. As a result, the interest rate on loans exceeded 15 percent. But the amount of deposits is not increasing in the banks.

Because you are getting a big house in a used flat, Titas gas line, ready interior, and you are getting an opportunity to live in a good area at a much lower price. Economist Ahsan H Munsoor said that most of the expatriates do different jobs outside the country. Their goal is to manage the family well and have a good housing system. It can be seen that expatriates usually invest their cash in accessible places. In that case they feel more comfortable to buy old flat or plot. Apart from this, there are many businessmen, who are also interested in investing in this sector.

Investing in various risky sectors with more greed. Mother was an officer of a state-owned bank. After retirement, the entire amount of pension was in son Shamim’s bank account. With his mother’s permission, Shamim invested Tk 10 lakh in BTech Communication OPC, an online company.

In the beginning, he saw some profit in his wallet when he bought bitcoins online. BTech Communication OPC lost a huge amount of money from Shamim and all the customers after the investment. Investment money will double in three to six months or the product is being offered at almost half the price at a special discount – such tempting offers are offered online.

This type of promotion is done using social media, own website or various apps. Many simple-minded people fall into the trap of fraudsters. In order to gain credibility in the first place, the customer’s investment is returned. Products are delivered to customers’ homes at half price. After that, the fraudsters started campaigning with those customers.

When the ‘business’ gets busy, the tussle starts. Customers have to pay dharna to get back the investment money. Even if months pass, the half price product is not available. In between, members of the fraudsters circle.

Investors are increasingly interested in treasury bills and bonds. Treasury bills and bonds are government borrowing instruments considered risk-free investments. By investing in these instruments, you get more interest than savings bonds or banks. The interest rate on one-year treasury bills is now 11.60 percent. Interest rates on long-term bonds rose to 12.17 percent.

Again, no tax has to be paid in this case like bank or savings bank profit. There is no investment ceiling. Can be sold to others if desired. Due to these benefits, investments in bills and bonds are increasing rapidly. On the other hand, many banks are not getting the expected deposits despite the increase in interest rates.

A senior official of Bangladesh Bank said that the stock market is either good or bad. Again, tax is deducted at source from bank and savings bank profits. Excise duty is deducted at various rates on deposits above Tk 1 lakh. Banks deduct various charges. Due to this, investment in treasury bills and bonds is increasing rapidly. However, many people do not know that individual investments can be made in bills and bonds.

Those who are aware, especially Bangladesh Bank, various bank and financial institutions’ officers-employees, government employees, businessmen are now keeping money in government securities.

Especially in some Sharia-based banks of the country, more loans are being distributed or invested than the amount of deposits. Deposits in these banks collectively increased by Tk 4,761 crore last February. However, in the same month, banks have loaned or invested Tk 6,452 crore. As a result, banks have invested Tk 1,691 crore more than deposits in one month.

People are losing their savings under the pressure of inflation. At one time there was a long line to buy savings certificates in Bangladesh Bank, but now it is no more. Instead, more people come to redeem savings cards. Going to Bangladesh Bank on Thursday, it was seen that some people have come to redeem the savings certificates before the expiry date. Some have come to redeem after expiry. Others have come to collect monthly or quarterly interest on savings bonds.

Maryam Begum, who works in a private institution, told, “My husband is not alive.” I kept the entire amount of his pension in a savings account. With that, the family was running with four children; But now the family does not survive with it. Because nowadays everything is very expensive. So, I came to know about redeeming the savings card. But if you redeem before the end of the term, the bank said that you will get much less money. Most of the middle class and low income people are in the same situation.

Instead of making new savings, they are breaking down previous savings. ABM Mirza Azizul Islam, the former financial adviser of the caretaker government, said, “The sale of savings bonds has declined mainly due to the imposition of strictures.” Apart from this, due to high inflation, common people are not getting much profit. This is also a major reason for reducing savings.

To reduce the debt burden, the government has reduced borrowing from savings bonds. At the same time, many people are not able to invest in savings certificates as before because TIN and bank account are mandatory. According to him, earlier black money was also invested in the savings sector. Now that is not happening. As a result, there has been a slowdown in the sale of savings bonds.

Expatriates have sent remittances, relatives have bought land and flats. Old flats worth Tk 8,000 crore were sold in property registration offices last year, a record in the last few years. Statistics show that relatives of expatriates living abroad bought the oldest flats in the housing sector during this period. A large part of which was remittances from abroad or expatriate income deposited in relatives’ banks.

Real Estate and Housing Association of Bangladesh (REHAB) Director Naeemul Hasan said that expatriates have bought the most old flats in the housing sector in the last two years. As the reason, he said, many expatriates do not want to leave money in the bank. They want an accommodation in a low budget. Due to this, the sale of old flats has increased.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…