Bank & Finance

Bank & Finance

BD received $23.91b in FY 2023-24:BB

Remittance hits 47-month high Staff Correspondent: Bangladesh has received US$ 23.915 billion in remittances for the fiscal year 2023-24, ending on June 30, marking the second highest remittance inflow in a fiscal year to date.MdMezbaulHaque, Executive Director and Spokesperson of Bangladesh Bank, told UNB that expatriate Bangladeshis sent $2.542 billion…

Read More »Corruption-money laundering the silent killer of economy

Enayet Karim: Corruption is always more or less a topic of discussion in the country. Corruption and money laundering are the most talked about topics in recent times. Unfortunately, and disappointingly for the citizens of the country, the focus of this discussion is the massive corruption, money laundering and irregularities…

Read More »Feasibility checks at end of project period

Indian debt in Railways Farhad Chowdhury: The 57 km railway from Parbatipur in Dinajpur to Kaunia in Rangpur is to be laid with Indian loan. The six-year project expires in 2023. The project has not started yet. Feasibility testing is still going on. It is supposed to end next December.…

Read More »Foreigners extract triple amount from BD compared to incoming remittances

Enayet Karim: Foreign workers took more than three times the amount of remittance flow sent by expatriates to the country in foreign currency for salary. In the 24 years from 2000 to 2023, the remittance flow of expatriates increased 11 times. At the same time, the tendency of foreign workers…

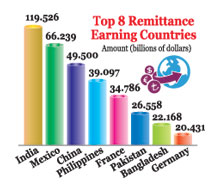

Read More »Bangladesh ranks 7th in collection of remittance

Staff Correspondent: A few years of high growth in global remittance flows will slow down in 2023. Global remittance flows have increased nominally during this period. This has had an impact on remittance receiving countries. Remittance growth was negative in many countries. In 2023, remittance flows to Bangladesh increased by…

Read More »Destination of money laundering shifts away from Switzerland

Bangladesh’s Deposits in Swiss Banks Drop by 68 Percent in 2023 Compared to 2022 Special Correspondent: The trend of Bangladeshi citizens depositing money in Swiss banks has seen a significant decline. Recent statistics released by the Swiss National Bank (SNB) reveal that the total amount held by Bangladeshi entities in…

Read More »Govt to spend Tk 1 tr from ADP in just 3 days

Financial year to end on June 31 Mahfuja Mukul: Only 3 days left for the end of the current (2023-24) financial year. Half of the Annual Development Program (ADP) has been implemented in the 11.5 month of the financial year i.e. till June 20. At this time, ADP implementation has…

Read More »Unbridled corruption persists despite ‘zero tolerance’ policy

Staff Correspondent: The election manifesto given by Awami League in the twelfth parliamentary elections before the formation of the government for the fourth consecutive term, emphasized the ‘zero tolerance policy against corruption’. After the implementation of ‘Digital Bangladesh’ under the leadership of Sheikh Hasina, the daughter of the father of…

Read More »IMF calls for urgent re form of banking sector

Staff Correspondent: The International Monetary Fund (IMF) has recommended strengthening the regulatory framework in the financial sector and accelerating reforms to ensure good governance. At the same time, transparency should be increased in the preparation of credit reports of the country’s financial sector in line with international best practices. In…

Read More »IMF lauds Bangladesh’s progress against NPLs

Staff Correspondent: The International Monetary Fund (IMF) has welcomed Bangladesh for progress in creating a roadmap to reduce the non-performing loans (NPLs).“Priorities should focus on reducing NPLs, implementing risk-based supervision, and enhancing corporate governance. In this context, we welcome the authorities’ progress in creating a roadmap to reduce NPLs, but…

Read More »