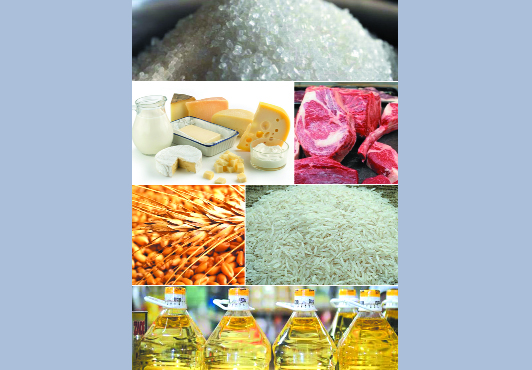

Food price reaches 10-yrs high in 2022

BD along with LDCs to face crisis: GEF

Special Correspondent: The food price during the year 2021 was ten years’ high due to the poor production, disruption of distribution system, and high inflation for the Covid-19 pandemic. The price of essential foods commodities will remain high in 2022 as per the prediction of Global Economist Forum (GEF), Food and Agricultural Organisation (FAO), World Bank and different International agencies. Bangladesh along with the LDC countries will be face the crisis if pandemic become pro-long during the year 2022.

According to the FAO Food Price Index (FFPI) wasaveraged 133.7 points in December 2021, down 1.2 points (0.9 percent) from November, but still up 25.1 points (23.1 percent) from December 2020. Except for dairy, the values of all sub-indices encompassed by the FFPI registered monthly declines, with international prices of vegetable oils and sugar falling significantly month-on-month. For 2021 as whole, the FFPI averaged 125.7 points, as much as 27.6 points (28.1 percent) above the previous year with all sub-indices averaging sharply higher than in the previous year.

Cereal Price Index averaged 140.5 points in December, down 0.9 points (0.6 percent) from November. Wheat export prices fell in December, amid improved supplies following harvests in the southern hemisphere and slowing demand. However, maize prices were firmer, underpinned by strong demand and concerns over persistent dryness in Brazil. While sorghum prices also rose, partly influenced by maize markets, barley quotations eased slightly. International rice prices also softened in December, as demand relapsed, and currencies weakened against the US dollar in various major suppliers. For 2021 as a whole, the FAO Cereal Price Index averaged 131.2 points, up 28.0 points (27.2 percent) from 2020 and the highest annual average registered since 2012. In 2021, maize and wheat prices were 44.1 and 31.3 percent higher than their respective 2020 averages, mostly on strong demand and tighter supplies, especially among major wheat exporters.

Rice was the sole major cereal to register a decline in prices in 2021, with quotations falling on average 4.0 percent below 2020 levels. The weakness reflected ample exportable availabilities of rice, which heightened competition among suppliers and led them to seek to counter the impact of high freight costs and container shortages on demand by lowering prices.

Vegetable Oil Price Index averaged 178.5 points in December, shedding 6.1 points (or 3.3 percent) from recent record highs. The decline was driven by weakening palm and sunflower oil prices, while soy and rapeseed oil values remained virtually unchanged month-on-month. International palm oil prices fell in December, primarily reflecting subdued global import demand amid concerns over the impact of rising COVID-19 cases. Meanwhile, international sunflower oil quotations were also weaker, reflecting demand rationing. By contrast, world soy and rapeseed oil prices maintained their strength, largely underpinned by, respectively, firm import demand primarily from India and protracted global supply tightness. For 2021 as a whole, the FAO Vegetable Oil Price Index averaged 164.8 points, up as much as 65.4 points (or 65.8 percent) from 2020 and marking an all-time annual high.

Dairy Price Index averaged 128.2 points in December, up 2.3 points (1.8 percent) from November and 19.0 points (17.4 percent) above its December 2020 value. In December, international quotations for butter and milk powders continued to increase, underpinned by high global import demand, coupled with tight export supplies, resulting from lower milk production in Western Europe and Oceania. Despite the low milk output, cheese production in Western Europe increased as producers preferred cheese over alternative dairy products, causing a marginal decline in cheese prices. In 2021, the FAO Dairy Price Index averaged 119.0 points, up 17.2 points (16.9 percent) from 2020, reflecting sustained import demand throughout the year, especially from Asia, and tight exportable supplies from the leading producing regions.

Meat Price Index averaged 111.3 points in December, marginally changed from November and 16.5 points (17.4 percent) above its year-earlier value. In December, poultry prices fell, primarily weighed by increased global exportable supplies, while ovine prices declined on increased supplies from Oceania. Meanwhile, pig meat prices fell for the sixth consecutive month, though slightly, as the continued downward pressure stemming from the decline in Chinese imports was compensated by increased pre-Christmas sales in major producing countries. In 2021, the FAO Meat Price Index averaged 107.6 points, up 12.1 points (12.7 percent) from 2020. Across the different categories, ovine meat registered the sharpest increase in prices, followed by bovine and poultry meats, while pig meat prices fell marginally.

Sugar Price Index averaged 116.4 points in December, down 3.8 points (3.1 percent) from November and a five-month low. The December decline reflected concerns over the impact of the Omicron COVID-19 variant on global demand for sugar following the resumption of containment measures in many regions. The weakening of the Brazilian Real against the US dollar and lower ethanol prices also contributed to lowering world sugar prices in December. For the year as a whole, the FAO Sugar Price Index averaged 109.3 points, up 29.8 points (or 37.5 percent) from 2020 and the highest since 2016. Throughout the year concerns over the reduced output in Brazil amidst stronger global demand for sugar underpinned the increase in prices.

President Joe Biden tests positive for COVID-19 while campaigning in Las Vegas, has ‘mild symptoms’

International Desk: President Joe Biden tested positive for COVID-19 while traveling Wedne…