Performance of last 3 governors substandard

Rouf Talukder ranked ‘D-grade’

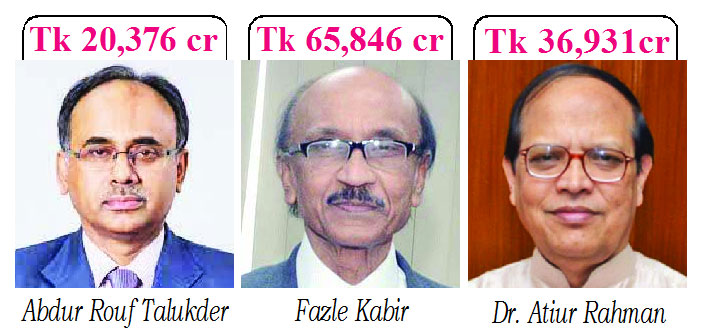

Staff Correspondent: In the last 15 years, three governors have served in the country’s banking sector. During the tenure of these three governors, the highest amount of defaulted loans increased, amounting to Tk 1 lakh 23 thousand 153 crores. At present, the amount of defaulted loans in the banking sector stands at over Tk one lakh 45 thousand 633 crores. The three governors are Dr. Atiur Rahman, Fazle Kabir and Abdur Rauf Talukder (currently in charge).

It is known that Abdur Rauf Talukder took charge as the 12th Governor of Bangladesh Bank on July 12, 2022. At that time i.e. at the end of June 2022, the size of defaulted loans of the banking sector was Tk 1 lakh 25 thousand 257 crores, which is 8.96 percent of the total disbursed loans. At the end of last December, the defaulted loans of the banking sector stood at Tk one lakh 45 thousand 633 crores, which is 9 percent of the total disbursed loans. In other words, within a year and a half of Abdur Rauf Talukda taking charge, the defaulted loans of the banking sector have increased by Tk 20,376 crores.

By joining Bangladesh Bank, he made many promises including controlling high inflation, stabilizing the unstable dollar market and reducing bad loans of the banking sector. Although he could not show any progress in two and a half years after taking charge. On the contrary, the dollar market has been unstable at this time. Food inflation and headline inflation hit record levels.

Fazle Kabir was the governor of Bangladesh Bank before Abdur Rauf Talukdar. He was the governor of Bangladesh Bank for seven years in two terms. During his two terms, the bank sector defaulted loans increased the most, amounting to Tk 65,846 crores. He assumed office as the Governor on March 22, 2016. At that time, the amount of defaulted loans in the banking sector was Tk 59,411 crores. His two terms ended on July 3, 2022. Before retiring, the defaulted loans of the banking sector stood at Tk 1 lakh 25 thousand 257 crores.

Fazle Kabir joined as the tenth governor of Bangladesh Bank on May 1, 2009. On completion of four years in the first term, the government extends its term further. During the four years of his first term, the defaulted loans in the banking sector increased by about Tk 20,250 crores. He was appointed for another four years but could not complete the term. He had to resign earlier in the case of reserve theft.

During his two terms, the total defaulted loans in the banking sector increased to Tk 36,931 crores. When he took charge, the amount of defaulted loans of the banking sector was Tk 22,480 crores. At the time of his resignation, he left bank sector defaulted loans of Tk 59,411 crores. The second highest non-performing loans in the banking sector increased during the governor’s tenure.

Besides, Salehuddin Ahmed served as the ninth governor of Bangladesh Bank. On May 1, 2005, he took charge as the governor of Bangladesh Bank. At that time, the amount of defaulted loans of the banking sector was Tk 17,510 crores. He passed away on 30 April 2009. At the time of departure, the amount of defaulted loans of the banking sector was Tk 22,480 crores. That is, during the tenure of this governor, the defaulted loans of the banking sector increased by Tk 4,970 crores.

Dr. Fakhruddin Ahmadpreviously served as the eighth governor of Bangladesh Bank. He served as Governor from 29 November 2001 to 30 April 2005. During his time defaulted loans increased to Tk 6,090 crores. Before this Dr. During the tenure of Mohammad Farasuddin, the default increased by Tk 3,697 crores. During the Lutfur Rahman government, the defaulted loans increased by Tk 8,849 crore and during Khorshed Alam’s tenure by Tk 4,480 crore.

Meanwhile, the current governor of Bangladesh Bank, Abdur Rauf Talukder, has received ‘D grade’ in the global ranking as a governor. Last September, he got a ‘D’ grade in the ranking of the New York-based Global Finance Magazine. The previous governor Fazle Kabir got B, D and C minus grades respectively for three years. And Dr. Atiur Rahman got C grade in two years.

It should be noted that the calculation of defaulted loans given by Bangladesh Bank is also not real information. Because the actual defaulted loans are much more. Many loans can’t be marked as defaulted due to litigation. Again, foreclosed loans are not defaulted. Also, rescheduled loans are not shown as defaults. The International Monetary Fund (IMF) favors rescheduling loans, repossessed loans and court-suspended loans as defaults.

According to the report of Bangladesh Bank, the status of rescheduled loans in the country at the end of 2022 was Tk 2 lakh 12 thousand 780 crore. Apart from this, another Tk 2 lakh 12 thousand crores and Tk 49,283 crores of foreclosed loans are withheld due to litigation. As a result, the total amount of actual defaulted loans will be more than six lakh crore rupees, which is 38 percent of the total loans.

Recently, Bangladesh Bank has announced a roadmap to reduce bad loans. Through this roadmap, the total non-performing loans of the banking sector will be brought down to below 8 percent by June 2026, which is at 9 percent now. And the non-performing loans of state-owned banks will be brought down to 10 percent and private banks’ non-performing loans to 5 percent, which stood at 20.99 percent and 5.93 percent respectively at the end of December.

Rare Israeli airstrike in Beirut kills Hezbollah commander and more than a dozen others

International Desk: Israel launched a rare airstrike that killed a senior Hezbollah milita…